Professional Monthly Accounts Finalization

A Monthly Ritual for Financial Clarity: Balancing the Books.

Monthly Accounts Finalization Services play a crucial role in helping businesses maintain accurate financial records, minimize errors, and stay fully compliant with Bahrain’s regulatory framework. Timely Month-End Financial Reporting Bahrain not only delivers reliable financial data but also empowers management, investors, and auditors to make well-informed decisions, improve transparency, and enhance overall operational efficiency.

By implementing structured Monthly Accounting Services in Bahrain, businesses gain clarity on cash flow, monitor profitability, and identify potential financial risks before they escalate. Regular financial oversight ensures that discrepancies are addressed promptly and that reporting aligns with regulatory expectations.

Finsoul Bahrain offers cloud-based, outsourced Monthly Accounts Finalization Services in Bahrain, enabling organizations of all sizes to handle Monthly Reconciliation in Bahrain, adjustments, and reporting seamlessly in real time. This approach ensures businesses stay audit-ready, optimize financial processes, and maintain consistent compliance with all local regulations.

Understanding Monthly Accounts Finalization and Its Benefits

Monthly Accounts Finalization starts with verifying and reconciling all financial transactions. Expense entries, revenue postings, and supporting documents are carefully reviewed to prevent discrepancies.

Monthly Reconciliation in Bahrain includes bank, cash, POS, and vendor accounts. Coordination with management ensures approvals, correction entries, and verification of incomplete data.

Benefits of Structured Month-End Finalization:

- Accurate Profit & Loss Statements, Balance Sheets, and Cash Flow Reports

- Improved operational efficiency and strategic decision-making

- Enhanced audit readiness and regulatory compliance

- Supports budgeting, working capital management, and real-time insights

Who Can Benefit from Monthly Accounts Finalization?

Every business in Bahrain, from SMEs to large enterprises, benefits from structured Monthly Financial Reporting. Companies with multiple branches, complex operations, or high transaction volumes gain not only faster and more efficient reporting but also enhanced VAT compliance and improved accuracy in their financial records.

This structured approach provides management with clear insights into cash flow, profitability, and overall financial health, enabling proactive decision-making and stronger control over operational and strategic outcomes.

Industries We Serve

Services are provided across a variety of sectors, recognizing that each industry has unique financial management needs. These services help businesses of all sizes stay organized, compliant, and efficient.

Retail & FMCG

Accurate sales and inventory reconciliation.

Restaurants & Food Chains

Efficient management of high-volume transactions.

Construction & Contracting

Streamlined project accounting and procurement processes.

Healthcare Clinics & Hospitals

Management of complex billing, payroll, and compliance.

Trading & Import/Export

Handling multi-currency accounts and cross-border compliance.

Corporate Offices

Support for businesses without full-time accounting teams.

Activities Included in Monthly Accounting Closure

- Verification of monthly expenses and revenue entries.

- Monthly Reconciliation in Bahrain for bank, POS, and cash accounts.

- Updates to receivables, payables, and accruals.

- Adjustment entries such as depreciation, provisions, and amortization.

- Preparation of End-of-Month Accounts in standard accounting report format.

VAT Compliance During Month-End

All supplier VAT invoices and related transaction documentation are meticulously reviewed to ensure accuracy and completeness. Each entry is carefully classified as either VAT-chargeable or non-chargeable, eliminating the risk of errors or misreporting.

Finsoul prepares comprehensive VAT-ready datasets for upcoming filings, ensuring full compliance with Bahrain NBT regulations. This process not only supports a smooth and hassle-free audit but also provides management with confidence in the accuracy of tax reporting and overall financial integrity.

How AI Enhances Monthly Accounts Finalization

Finsoul Bahrain integrates AI tools to significantly enhance the accuracy and efficiency of Monthly Accounts Finalization. Automated invoice extraction and categorization minimize manual entry errors, ensuring that all financial transactions are recorded correctly. Smart reconciliation checks further improve reliability by detecting discrepancies automatically, reducing the risk of mistakes, and ensuring consistent compliance with Bahrain Financial Close Process requirements.

In addition, real-time dashboards give businesses clear visibility into profitability, sales, and costs, enabling management to monitor performance continuously. Predictive cash flow tools provide actionable insights into future trends, allowing companies to plan strategically, optimize liquidity, and make well-informed financial decisions, reinforcing the value of Month-End Financial Reporting Bahrain.

Documents Required for Monthly Accounts Finalization

To ensure accurate Month-End Financial Reporting in Bahrain, businesses must provide complete and precise documentation. These documents help streamline the Accounting Finalization Process in Bahrain, maintain compliance, and support audit readiness.

Key Documents Needed:

- Monthly Sales Reports, POS Summaries, and Supplier Invoices: Record of all revenue transactions

- Expense Receipts and Payment Vouchers: Proof of business expenditures

- Petty Cash Records and Payroll Data: Employee payments and small cash transactions

- Bank Statements and Pending Invoices: Complete banking activity and outstanding amounts

- Contracts, Credit Notes, and Allowances: Agreements and financial adjustments supporting entries

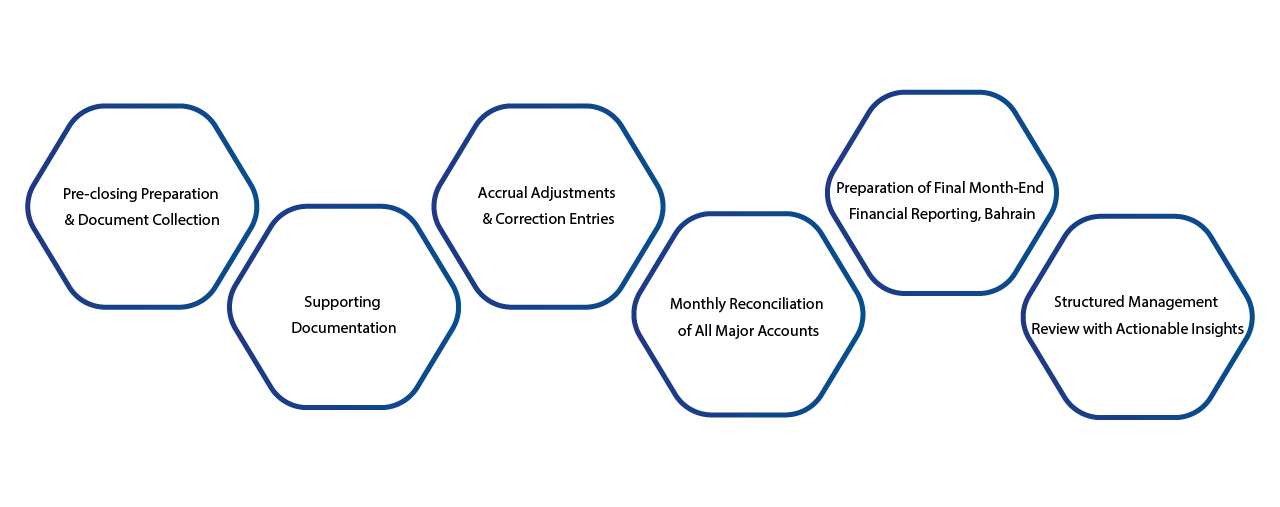

Step-by-Step Workflow

- Pre-closing Preparation & Document Collection: Gather all relevant financial documents, invoices, receipts, and records to ensure nothing is missing before the month-end process begins.

- Verification of Financial Entries & Supporting Documentation: Check each transaction for accuracy, confirm supporting documents, and correct any inconsistencies before posting.

- Accrual Adjustments & Correction Entries: Record necessary accruals, depreciation, provisions, and adjust incorrect entries to reflect true financial performance.

- Monthly Reconciliation of All Major Accounts: Reconcile bank accounts, cash, POS, and vendor accounts to ensure balances are accurate and up to date.

- Preparation of Final Month-End Financial Reporting, Bahrain: Compile all financial data into standardized reports, including Profit & Loss, Balance Sheet, and Cash Flow Statements.

- Structured Management Review with Actionable Insights: Present finalized reports to management with analysis, highlighting discrepancies, and providing recommendations for informed decision-making.

Estimated Timeline and Cost

| Service Type | Estimated Timeline | Estimated Cost (BHD) | Notes |

|---|---|---|---|

| Small Businesses | 5–7 days | 400 – 800 | Low transaction volume SMEs |

| Medium Businesses | 7–10 days | 800 – 1,500 | Includes reconciliation, adjustments, and reporting |

| Large Enterprises | 10–15 days | 1,500 – 3,000 | Multi-branch or high-volume accounting support |

| Outsourced Full-Service | Daily updates | Custom pricing | Comprehensive outsourced monthly accounts finalization services including VAT, payroll, and analytics support |

Disclaimer: The estimated timelines and costs may vary depending on transaction volume, complexity, and business needs. Contact Finsoul Bahrain to discuss your requirements and receive a professional solution.

Why Choose Finsoul Bahrain?

As a top monthly accounts finalization firm, we combine local expertise, advanced technology, and professional experience to ensure seamless month-end processes, audit readiness, and actionable financial insights.

- Certified Accountants with Local Expertise: Knowledgeable in Bahrain accounting standards and VAT rules

- Accurate & Timely Reporting: Reliable Monthly Accounting Services in Bahrain and dashboards

- Secure Cloud Accounting Setup: Protects data and allows easy access

- Trusted Across Industries: Serving SMEs, large enterprises, and multi-branch organizations

- Confidentiality & Compliance: Ensures privacy and regulatory compliance

FAQs

How long does Monthly Accounts Finalization usually take?

Typically 5–15 days depending on business size and transaction volume.

Can Finsoul handle high-volume daily transactions?

Yes, our team scales to ensure accuracy for large enterprises.

Does Monthly Accounts Finalization include VAT filing support?

Yes, all reconciliations are VAT-ready and comply with Bahrain NBT requirements.

Can Finsoul work with existing accounting software?

Absolutely, we integrate with ERP and cloud accounting platforms seamlessly.

What reports are delivered at month-end?

Month-End Financial Reporting Bahrain includes Profit & Loss, Balance Sheet, Cash Flow Statement, and management notes highlighting discrepancies.