Interim Review

Revitalizing the Roadmap: Interim Reviews for Strategic Adaptation

Interim Review in Bahrain

Interim Review Services offer businesses a structured, mid-year evaluation of financial health, acting as a vital checkpoint before the annual audit. These reviews focus on analytical procedures, inquiries, and business interim assessment techniques to deliver insights based on interim financial statements. Finsoul Bahrain provides one of the best Interim Review Services aligned with international standards, helping identify inconsistencies early and enhance compliance. This interim solution supports timely decision-making, performance tracking, and operational improvement through focused interim business analysis. From interim report preparation to interim audit support, Finsoul ensures businesses stay informed and audit-ready with reliable financial review services designed for accuracy and clarity. Ideal for businesses needing interim consultant analytics, these services boost financial clarity and ease year-end audit pressure.

Importance of Interim Review Services

Interim Review Services support financial accuracy and offer early insights for better decisions and ongoing compliance.

- Proactive Risk Management: Interim financial review Bahrain helps identify issues early, reducing year-end surprises and improving business resilience.

- Regulatory and Compliance Assurance: Mid-year checks support business compliance Bahrain by aligning financials with local regulations and maintaining audit readiness.

- Stakeholder Transparency: Interim reviews provide stakeholders with timely, reliable insights—boosting trust and informed decision-making.

- Enhanced Financial Control: Reviews enable timely budget and reporting adjustments, improving financial control before year-end.

Benefits of Interim Financial Reviews

Interim financial reviews offer mid-year insights, helping businesses stay on track and adjust as needed. Here are the key benefits:

Timely Insights

Interim review service Bahrain highlights errors and discrepancies early, supporting quicker decisions and strengthening financial stability.

Better Planning

Mid-year evaluations help fine-tune budgets and forecasts, improving Bahrain financial oversight and guiding the rest of the fiscal year.

Increased Credibility

Clear interim reports boost trust with investors, banks, and regulators, reinforcing confidence in financial governance.

Improved Financial Accuracy

Identifying issues early reduces heavy year-end adjustments, keeping records cleaner and reporting smoother.

Efficient Year-End Audits

A key benefit of interim audit reviews is quicker year-end auditing, as early fixes streamline the final process.

How Interim Review Services Are Conducted?

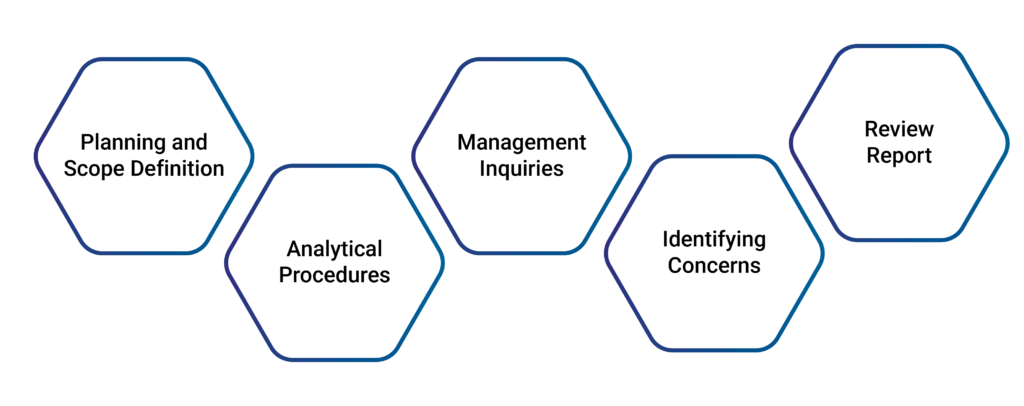

Interim review services are conducted through a structured process designed to ensure comprehensive financial assessment and insights. The steps involved include:

- Planning and Scope Definition: The review process begins by defining the scope and objectives, ensuring alignment between the business and reviewers on key focus areas.

- Analytical Procedures: Financial data is compared with historical trends, budgets, and benchmarks to identify variances and assess performance.

- Management Inquiries: Interviews with key personnel clarify financial movements, providing context for discrepancies and deeper insights into operations.

- Identifying Concerns: Discrepancies or concerns are flagged for management, enabling early resolution of potential issues.

- Review Report: A formal report summarizes findings and recommendations, helping management improve financial control and make informed decisions.

Industries We Served for Interim Reviews

Interim review services help diverse sectors maintain financial oversight, support performance checks, and meet compliance needs.

- Small and Medium Enterprises (SMEs): Interim audit for SMEs enhances mid-year accuracy and keeps businesses in Bahrain audit-ready without waiting for year-end.

- Corporations: For complex structures, interim reviews support corporate compliance Bahrain by offering board updates and early trend identification.

- Investor-Focused Companies: Regular reviews provide current financial data, strengthening investor trust and accountability.

- Public Sector Entities and NGOs: Financial review for businesses Bahrain supports regulatory compliance and transparency for donors and authorities.

- Newly Established Businesses: For startups and early-stage firms, interim assessments track financial performance, support audit preparation, and help build trust with potential investors.

Why Choose Finsoul Bahrain for Interim Reviews?

Partnering for interim financial reviews boosts oversight, audit readiness, and smarter decisions. Finsoul Bahrain offers key advantages:

- Experienced Professionals: Skilled accountants in Bahrain with IFRS and regional compliance knowledge deliver dependable, accurate interim reviews.

- Flexible and Scalable Services: Reviews are designed to fit varying business sizes and needs, ensuring appropriate engagement at every stage.

- Objective, Unbiased Reporting: As an independent audit firm in Bahrain, Finsoul offers neutral, clear insights that support governance and decision-making.

- Integrated Financial Support: Interim reviews align with broader functions—accounting, tax, and compliance—for unified support from trusted financial advisors.

- Commitment to Transparency: Emphasis on financial clarity helps businesses build confidence and meet stakeholder expectations year-round.

(FAQs) - Interim Reviews

Finsoul’s interim reviews deliver timely, transparent data that supports investor trust and board-level decision-making.

The report summarizes key findings, variances, inquiries, and recommendations to enhance financial control and readiness.

The duration depends on the size and complexity of the business but typically ranges from one to three weeks, including planning, procedures, and reporting.

Yes, interim reviews may reveal unusual trends or variances that suggest potential fraud or misstatements early in the year.

Interim reviews are usually done once or twice a year, often mid-year or quarterly, based on business size and reporting needs.