Transaction Advisory

Guiding Transactions, Maximizing Value: Your Partner in Strategic Advisory Excellence

Handling mergers, acquisitions, investments, expansions, and divestments demands expert financial guidance to handle their complexity effectively. Transaction advisory services in Bahrain offer businesses precise support, including risk assessment, pricing analysis, and strategic recommendations for each deal.

By partnering with Finsoul Bahrain, companies benefit from end-to-end assistance throughout deal preparation, structuring, and execution. This comprehensive approach ensures informed decision-making, minimizes potential risks, and helps achieve optimal outcomes for all parties involved.

Finsoul Bahrain: Leading Corporate Deal Consultant

With extensive experience in both local and cross-border transactions, we provide corporate transaction services in Bahrain that blend strong analytical capabilities, advanced financial modeling, and compliance-focused advisory. Their approach ensures that every transaction is carefully assessed, leveraging deep market insights and strategic foresight.

Through transparent processes and customized strategies, Finsoul supports SMEs, large enterprises, and investors alike. This comprehensive guidance enables clients to handle Bahrain’s complex business environment with confidence, making informed decisions while optimizing outcomes at every stage of the transaction.

Why Companies in Bahrain Seek Transaction Support

Businesses in Bahrain increasingly rely on transaction management services to support market expansion, corporate restructuring, and new investment initiatives. The country’s focus on economic diversification and the opportunities arising from Vision 2030, along with growing mergers and heightened foreign investor activity, make professional transaction guidance more essential than ever.

Engaging expert advisory services helps reduce financial and operational risks, ensures the accuracy of financial reporting, and strengthens compliance with regulatory requirements. This level of support encourages confidence among all stakeholders, enabling businesses to pursue growth and strategic opportunities with greater certainty and efficiency.

Preparing for Transaction Advisory

To handle a successful transaction, businesses should:

- Organize internal documentation.

- Review financial performance and projections.

- Assess compliance, liabilities, and tax exposure.

- Align deal strategy with long-term corporate goals.

Support for Investors, Buyers, and Sellers

We provide end-to-end financial transaction support Bahrain, including:

- Buy-side investigation and valuation review.

- Sell-side readiness assessment.

- Transaction structuring and negotiation assistance.

- Post-deal transition and integration support.

Documents Needed Before Entering a Deal

Before finalizing any deal, having the right documents ensures due diligence, reduces risks, and provides a clear view of the business.

Key Documents Needed:

- Financial Statements: Profit & loss, balance sheet, and cash flow statements (preferably 3 years).

- Bank Statements & Cash Flow Data: Historical statements and detailed cash flow records.

- Legal Documents, Contracts & Leases: Agreements, licenses, and property leases.

- Tax, VAT & Compliance Records: Filed tax returns, VAT documentation, and regulatory compliance proofs.

- Business Plans or Projections: Strategic plans, forecasts, and growth projections.

- Shareholding & Organizational Details: Ownership structure, board details, and corporate hierarchy.

Our Process

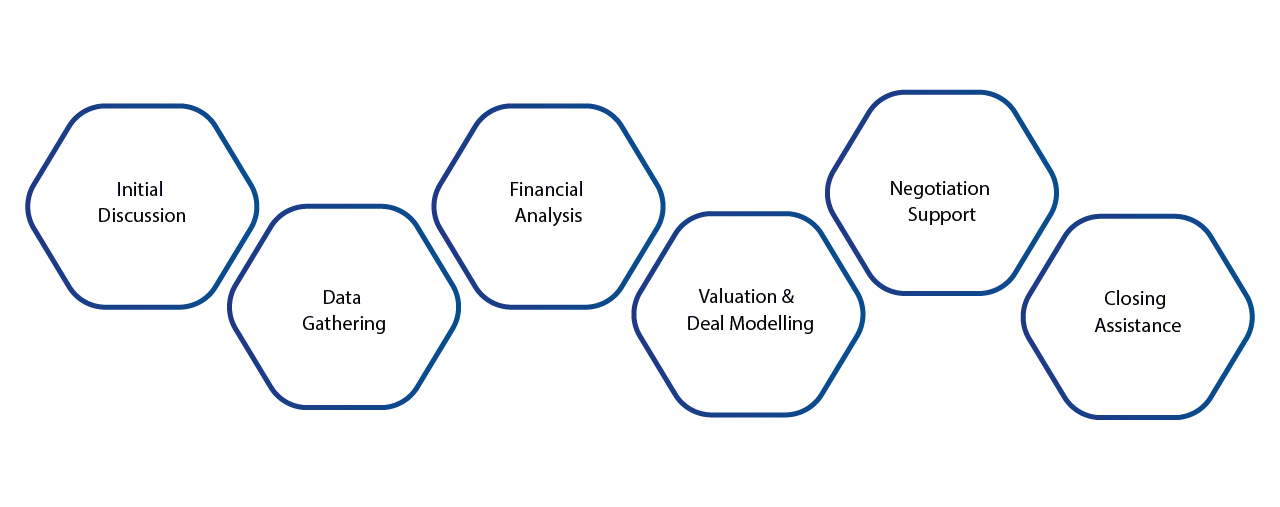

Follows a structured approach for business transaction advisory in Bahrain, ensuring all transactions are handled professionally, efficiently, and transparently.

- Initial Discussion & Deal Objective Assessment: Understanding the company’s goals, strategy, and desired outcomes for the transaction.

- Information Review and Data Gathering: Handling relevant financial, legal, and operational documents to provide a complete overview.

- Due Diligence & Financial Analysis: Assessing risks, liabilities, and opportunities, providing detailed insights for decision-making.

- Valuation and Deal Modelling: Customizing financial models and scenario analysis to estimate transaction value accurately.

- Structuring & Negotiation Support: Designing optimal deal structures, advising on negotiation strategies, and maximizing value.

- Closing Assistance & Post-Transaction Follow-Up: Handling final execution, compliance checks, and smooth integration post-deal.

Technology & AI Integration

Advanced platforms and AI technologies to deliver efficient business transaction advisory services in Bahrain. Their solutions include AI-assisted financial anomaly detection, predictive valuation modeling, automated document review, and sophisticated risk scoring engines, all designed to enhance accuracy and reliability.

By integrating these tools into their workflow, Finsoul streamlines complex transactions, minimizes errors, and accelerates the advisory process. Clients benefit from real-time insights and data-driven guidance, enabling more informed strategic decision-making and a smoother, more secure transaction experience.

Industries We Serve

We provide financial transaction services in Bahrain across a wide range of industries. We understand that each sector has unique requirements for mergers, acquisitions, investments, and expansions. Our transaction advisory services help businesses of all sizes handle transactions efficiently, mitigate risks, and ensure regulatory compliance.

Industries That Benefit from Our Services:

- Trading & Manufacturing: Evaluate acquisitions, divestments, and expansions while ensuring compliance and operational efficiency.

- Real Estate & Construction: Support property investments, joint ventures, and corporate restructuring with accurate financial analysis.

- Logistics & Distribution: Manage strategic partnerships, acquisitions, and growth projects with detailed transaction guidance.

- Financial Services: Offer regulatory-compliant investment advisory, merger support, and portfolio assessment.

- Tech Startups: Provide funding advisory, valuation preparation, and investor-ready documentation for expansions and acquisitions.

- Hospitality & Retail: Facilitate expansions, mergers, and joint ventures with robust financial insights and compliance checks.

Expected Costs & Timelines

| Service | Estimated Timeline | Estimated Cost (BHD) | Notes |

|---|---|---|---|

| Initial Review | 3–7 days | 800 – 1,500 | Preliminary assessment and strategic evaluation |

| Due Diligence | 1–4 weeks | 1,500 – 3,500 | Risk, liability, and compliance analysis |

| Valuation & Modelling | 1–2 weeks | 1,000 – 2,500 | Detailed financial modelling and scenario planning |

| Deal Execution | 3–12 weeks | Custom | Depending on complexity, negotiation, and approvals |

Disclaimer: Timelines and costs vary based on deal size, complexity, and regulatory requirements. Contact our professionals for a customized quote.

Why Choose us

Finsoul Bahrain delivers high-accuracy financial analysis and comprehensive financial transaction services within Bahrain, providing clients with strategic insights and robust negotiation support. Their expertise spans the entire transaction process, offering end-to-end guidance from initial planning through to successful closure.

With a strong focus on confidentiality and meticulous documentation handling, Finsoul ensures that sensitive information remains secure at every stage. Their deep understanding of Bahrain’s regulatory environment allows businesses to receive actionable, compliant advice, enabling confident decision-making throughout the transaction lifecycle.

FAQs

What is the difference between buy-side and sell-side support?

Buy-side support involves evaluating potential acquisitions and investments, while sell-side support prepares your business for sale, maximizes value, and handles investor communications.

How long does a typical commercial deal take in Bahrain?

Timelines vary by complexity, but most deals range from 3 to 12 weeks, including due diligence, valuation, and negotiation stages.

How accurate are valuations during transactions?

Finsoul Bahrain uses advanced financial modelling, scenario analysis, and AI-driven tools to provide precise, realistic valuations.

What risks usually appear during due diligence?

Common risks include undisclosed liabilities, compliance issues, financial misstatements, and operational gaps. Our structured process identifies these early.

Can small businesses also benefit from deal advisory?

Yes, SMEs gain valuable insights for investment decisions, expansions, or partnerships, benefiting from customized transaction management services designed for businesses of all sizes.