Employee Insurance

Boosting Your Group: Consistent Guidelines, Limitless Opportunities

Introduction to Employee Insurance Services

Ensuring proper employee insurance in Bahrain is a cornerstone of business continuity, regulatory compliance, and workforce satisfaction. In Bahrain’s dynamic corporate environment, providing corporate health insurance Bahrain secures employee wellbeing while safeguarding employers from unexpected liabilities related to work injuries, medical emergencies, and long-term financial support for staff.

At Finsoul Bahrain, we specialize in insurance services for employees, delivering tailored business health insurance Bahrain solutions that align with Bahrain Labour Law and LMRA mandates. Whether businesses require group insurance Bahrain, workmen’s compensation coverage, or custom employee protection plans, we ensure structured, compliant solutions that meet national requirements and industry-specific needs.

With Bahraini insurance regulations influenced by Bahrain’s corporate governance standards, we offer scalable, compliant, and affordable employee insurance policies designed for startups, SMEs, and large enterprises across Bahrain.

Importance of Employee Insurance in Bahrain

Effective employee benefits Bahrain strategies strengthen workforce morale while ensuring businesses meet local labor laws regarding insurance coverage.

Legal Compliance & Employee Welfare

Providing mandatory insurance Bahrain ensures businesses remain compliant with LMRA insurance rules, guaranteeing appropriate healthcare and injury protection benefits.

Employee Retention & Workforce Satisfaction

Offering health insurance for staff Bahrain secures long-term employee loyalty while minimizing turnover. Bahrain employee benefits insurance enhances recruitment competitiveness, making businesses attractive to skilled professionals.

Risk Management & Financial Protection

Ensuring structured business insurance Bahrain helps companies mitigate financial burdens related to workplace accidents, injuries, or long-term healthcare requirements.

With professional insurance services Bahrain, businesses can protect employees while securing future growth opportunities through well-managed insurance solutions.

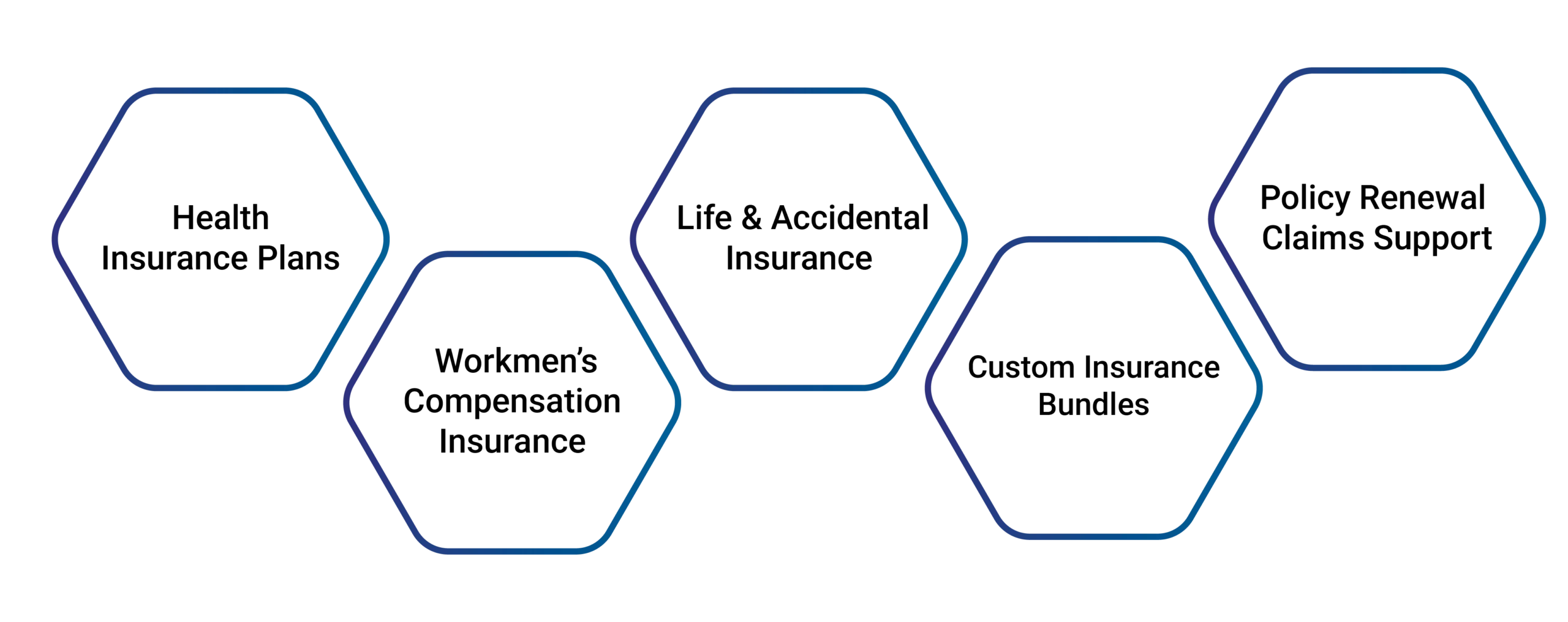

Our Employee Insurance Services

Businesses require comprehensive corporate insurance Bahrain to ensure structured employee insurance policies covering diverse workforce needs. At Finsoul Bahrain, we provide tailored plans to help businesses meet Bahrain insurance employees requirements.

Health Insurance Plans

- Comprehensive group medical policies with licensed insurers approved by the Central Bank of Bahrain (CBB).

Workmen’s Compensation Insurance

- Coverage for injury, disability, or employee fatalities occurring during employment.

Life & Accidental Insurance

- Structured employee protection plans ensuring financial security for dependents in case of unforeseen incidents.

Custom Insurance Bundles

- Industry-specific insurance packages designed according to workforce size, operational risks, and financial sustainability requirements.

Policy Renewal & Claims Support

- Full assistance with policy renewals, insurance claims processing, and coordination with service providers.

Compliance with Bahrain Labour Law & Regulations

Companies must provide Bahrain insurance employees policies to expatriates under LMRA regulations, ensuring structured healthcare provisions.

- Social Insurance Organization (SIO) Compliance

Businesses must adhere to employee social insurance mandates covering injury compensation, pension contributions, and structured workforce welfare planning. - Audit Preparation & Regulatory Documentation Support

Businesses must ensure compliance with Bahrain employment benefits, preparing appropriate documentation for insurance audits and workforce inspections. - Upcoming Insurance Mandates & Healthcare Schemes

Government initiatives may introduce unified healthcare schemes impacting private sector directives, requiring businesses to stay informed about changing policies.

Why Choose Finsoul Bahrain for Employee Insurance Advisory?

- Expertise in Bahrain’s Insurance Regulations: With a deep understanding of employee national insurance Bahrain policy requirements, our insurance advisory experts ensure seamless policy implementation.

- Affordable & Scalable Business Insurance Solutions: We provide cost-effective insurance plans tailored to SMEs, corporates, and free zone businesses, ensuring structured insurance strategies.

- End-to-End Insurance Advisory & Claims Processing: From policy design to renewals and claims handling, we offer transparent consulting services ensuring comprehensive workforce protection.

- Strong Partnerships with Leading Insurance Providers: Our relationships with the best insurance companies in Bahrain ensure access to structured professional insurance services Bahrain, offering businesses reliable coverage options.

FAQ's

Yes, businesses must ensure mandatory insurance Bahrain compliance under LMRA and SIO guidelines covering healthcare benefits for employees.

Companies must provide structured Bahrain insurance employees coverage for expatriates under LMRA regulations, ensuring healthcare provisions and work-related protections.

Yes, companies can structure Bahrain employee benefits insurance plans according to different employment levels, risk categories, and tenure-based benefits.

Absolutely. We specialize in policy renewals, claims support, and full-service workforce insurance advisory for businesses across Bahrain.

Businesses can opt for unified group insurance Bahrain plans or custom workforce segmentation, ensuring tailored coverage options for both local and expatriate employees.