Company Liquidation in Bahrain

Company liquidation services involve the structured closure of a business, ensuring compliance with legal, financial, and regulatory requirements. Proper liquidation safeguards stakeholders, mitigates liabilities, and facilitates smooth exit strategies.

Our services are applicable for SMEs, startups, and corporate entities, combining expertise in finance, law, and governance to ensure the liquidation of a company is handled efficiently. By implementing a structured approach, businesses can maintain compliance while protecting their reputation with regulators and stakeholders.

Finsoul Bahrain: Top Liquidation Services Provider

Recognized as a leading consultancy for company liquidation in Bahrain, Finsoul Bahrain offers a blend of legal, financial, and technology-driven expertise.

Key Differentiators:

- Experienced legal and financial professionals

- In-depth knowledge of Bahrain and GCC corporate laws

- Tech-driven management of the company liquidation process

Why Proper Liquidation Matters for Businesses

A formal company liquidation procedure ensures compliance with Bahrain commercial laws, helping businesses avoid legal issues and operate within regulatory frameworks. It also prevents penalties, fines, and other legal complications that can arise from improper closure.

Furthermore, proper liquidation protects directors and shareholders from future liabilities and helps maintain the company’s reputation with regulators and stakeholders, ensuring a smooth and responsible exit from the market.

How Can SMEs Benefit from Liquidation Services?

SMEs can gain significant advantages from structured company liquidation services, starting with structured exit planning that ensures a smooth and orderly closure.

These services also facilitate the settlement of outstanding liabilities, helping businesses clear debts efficiently and avoid future disputes.

Additionally, proper closure of licenses and permits ensures full regulatory compliance, while the efficient transfer or disposal of assets helps maximize value and streamline the overall company liquidation process.

Core Services Offered

A. Voluntary Liquidation

- Initiating business closure based on shareholder decision

- Asset evaluation and settlement of debts

- Submission of required documents to regulatory authorities

B. Compulsory Liquidation Support

- Assistance in court-directed liquidations

- Coordination with creditors and legal authorities

- Preparation of financial statements and reports

C. Regulatory Compliance & Governance

- Ensure closure follows Bahrain’s commercial laws

- Settlement of VAT, tax, and social insurance obligations

- Compliance with labor and employment regulations

D. Digital Tools & AI Integration

- AI-assisted tracking of company liquidation process deadlines

- Automation of document submission and reporting

- Real-time dashboards for monitoring closure progress

- Minimizes errors and accelerates the liquidation procedure

Why Outsource Company Liquidation Services?

Outsourcing company liquidation services provides access to expert guidance without the need to maintain internal legal or finance teams, ensuring that every step of the company liquidation process is handled efficiently and accurately. It helps businesses avoid regulatory non-compliance and associated risks.

Additionally, outsourcing streamlines processes to reduce the overall time required for closure and is a cost-effective solution compared to hiring full-time legal or finance staff, allowing organizations to manage liquidation smoothly and professionally.

Common Challenges in Company Liquidation

- Delays due to incomplete documentation

- Disputes with creditors or shareholders

- Complexity in clearing liabilities and assets

- Compliance with regulatory authorities

- Risk of penalties for non-compliance

Documents Required for Company Liquidation

To ensure a smooth and compliant company liquidation process, it is important to gather the correct business and financial documents. These records help settle liabilities, comply with Bahraini regulations, and finalize closure efficiently.

Key Documents Needed:

- Trade License & Company Registration: Proof of legal establishment and registration in Bahrain.

- Articles of Association or Incorporation: Foundational documents outlining company structure and ownership.

- Past Financial Statements: Records of financial performance to assess liabilities and assets.

- Bank Statements & Tax Records: Verification of cash flows, accounts, and compliance with tax obligations.

- Employee Records & Payroll Data: Information on staff, salaries, and benefits for proper closure.

- Previous Approvals, Permits & Regulatory Filings: Documentation of prior licenses, permits, and compliance submissions.

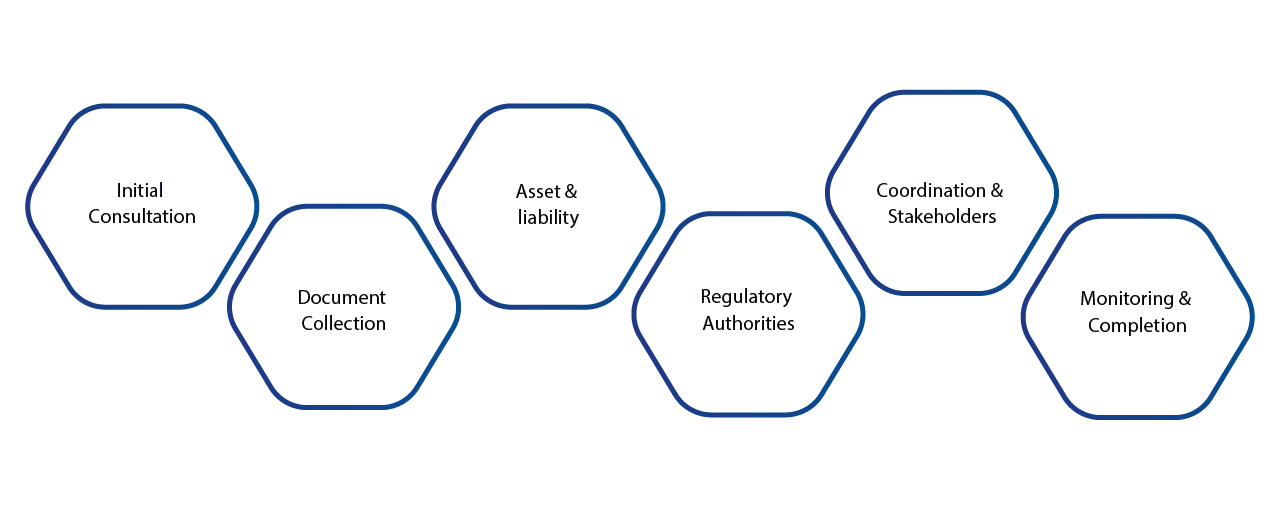

Process Followed

- Initial consultation and assessment of business closure: Review the company’s current status and determine the scope and requirements for a smooth company liquidation process.

- Collection and verification of all required documents: Gather and validate licenses, financial records, and other necessary documentation to ensure completeness for the liquidation of the company.

- Asset and liability evaluation to determine the liquidity position of a company: Assess assets and debts to understand the liquidity position of a company before proceeding.

- Submission to regulatory authorities: File all necessary documents and reports with the relevant Bahraini authorities as part of the company’s liquidation procedure.

- Coordination with creditors and stakeholders: Communicate and settle obligations with creditors, shareholders, and other stakeholders during the company’s liquidation process.

- Monitoring and completion of the company under liquidation process: Track all activities, ensure compliance, and finalize the company liquidation procedure efficiently.

| Service Type | Estimated Timeline | Estimated Cost (BHD) | Notes |

|---|---|---|---|

| Initial Assessment | 2–5 days | 600 – 1,200 | Review company status and closure requirements |

| Voluntary Liquidation | 2–6 weeks | 1,500 – 3,000 | Depends on asset and liability settlement |

| Compulsory Liquidation | 4–12 weeks | 3,000 – 6,000 | Court-directed and more complex cases |

| Ongoing Monitoring | Monthly | 300 – 700 per month | Track approvals, deadlines, and compliance |

Disclaimer: The estimated timelines and costs may vary depending on company size, assets, and regulatory requirements. Contact us for professional company liquidation solutions customized to your organization.

Technology and Tools

- Cloud-based platforms for document management

- AI-driven monitoring of submission deadlines

- Automated reporting and notifications

- Secure client collaboration portals

- Dashboards for real-time progress tracking

AI Integration in Company Liquidation Services

AI significantly enhances the company’s liquidation process by providing predictive alerts for filing deadlines and approvals, ensuring that no critical tasks are missed. It automates the tracking of regulatory requirements and offers dashboard visualizations of pending tasks and compliance gaps, giving businesses a clear overview of the liquidation progress.

Additionally, AI reduces human error, accelerates the closure process, and enhances decision-making by delivering real-time insights, allowing organizations to manage the liquidation efficiently and confidently.

Industries We Serve

Finsoul Bahrain provides company liquidation services in Bahrain for a wide range of industries. We understand that each sector has unique legal, financial, and regulatory requirements, from settling liabilities to closing licenses and permits. Our services help businesses of all sizes execute smooth and compliant liquidation processes.

- Manufacturing & Trading: Efficiently close operations, settle debts, and transfer or liquidate assets.

- Financial Services: Ensure regulatory compliance and proper handling of financial obligations.

- Technology & Startups: Streamline the closure of operations while protecting stakeholders.

- Healthcare & Education: Manage asset transfers, staff obligations, and licensing compliance.

- Real Estate & Construction: Properly settle contracts, projects, and licenses during liquidation.

- Government & Public Sector: Ensure adherence to public sector rules and maintain regulatory compliance.

Why Choose Finsoul Bahrain

We offer proven experience in delivering smooth and compliant company liquidation services, ensuring businesses exit efficiently while meeting all regulatory requirements.

With AI-assisted monitoring and reporting, every step of the company’s liquidation process is tracked for accuracy and timeliness. Their transparent and structured methodology provides clarity and confidence, while customized solutions cater to both SMEs and corporates. Deep expertise in Bahrain and GCC regulations ensures full compliance and mitigates potential risks throughout the closure process

FAQs

What is the difference between voluntary and compulsory liquidation?

Voluntary liquidation is initiated by shareholders, whereas compulsory liquidation is court-directed.

How long does a typical company liquidation in Bahrain take?

Voluntary liquidation usually takes 2–6 weeks; compulsory liquidation may take 4–12 weeks, depending on complexity.

What documents are required to initiate liquidation?

Trade license, incorporation documents, financial statements, bank records, employee data, and prior approvals.

Can Finsoul assist with clearing debts and liabilities?

Yes, our experts handle all creditor coordination and asset settlement efficiently.

How does AI improve the liquidation process?

AI tracks deadlines, automates compliance checks, reduces errors, and provides real-time insights for faster closure.