Actuarial Valuation Services in Bahrain

Shaping Financial Futures with Precision and Insight

Financial accuracy and compliance are not bargaining points in the present-day business environment. That is where actuarial valuation services are available. At Finsoul Bahrain, we do not do the bare-bone calculations, but we actually have accurate information on the liabilities of various employees on benefits, pension liabilities, and risks at a long-term investment at a financial risk.

What Is Actuarial Valuation and Why Does It Matter

Actuarial valuation is a structured and scientific process used to calculate the present value of future employee benefit obligations and long-term liabilities.

Unlike standard accounting estimates, it uses statistical models, demographic assumptions, and financial forecasting to provide a realistic picture of future liabilities.

For employers and auditors, actuarial valuation ensures that benefit costs are accurately recognized in financial statements.

It’s an essential compliance step under IFRS, IAS 19, and the Central Bank of Bahrain (CBB) guidelines, supporting fair disclosures and investor confidence.

Why Actuarial Valuation Is Crucial for Businesses in Bahrain

In Bahrain’s evolving business environment, actuarial valuation is more than a compliance formality, it’s a financial safeguard.

Here’s why it matters:

- Regulatory Scrutiny: Increased focus on transparent employee benefit reporting.

- IFRS & Audit Alignment: Ensures liabilities comply with global reporting frameworks.

- Financial Governance: Supports better planning and corporate risk management.

- Mergers & Acquisitions: Provides accurate data for due diligence and restructuring.

At Finsoul Bahrain, we provide actuarial valuation in line with Bahrain Labour Law, IFRS, and CBB guidelines to ensure your business meets every compliance benchmark.

Core Offered by Finsoul Bahrain

We provide a complete range of actuarial valuation services to meet the needs of businesses across Bahrain and the GCC.

Employee Benefits Valuation (IAS 19 / IFRS 19)

We assess end-of-service benefits, leave encashment, and employee liabilities to ensure accurate and compliant financial reporting.

Insurance and Pension Fund Valuation

Our experts evaluate insurance reserves and pension obligations to maintain solvency and support long-term financial planning.

Liability and Risk Valuation

We calculate medical, compensation, and other long-term liabilities to help businesses manage financial risks effectively.

Business and Financial Valuation Support

We provide actuarial insights for mergers, acquisitions, and restructuring to ensure fair, risk-adjusted business valuations.

What Are the Best Software Tools for Actuarial Valuation?

At Finsoul Bahrain, we combine global actuarial software with customized regional models for accuracy and compliance.

Some of the key tools we use include:

- Prophet by FIS: For actuarial modeling and risk projections.

- Mo.net: For insurance and pension plan analysis.

- GGY AXIS: For large-scale actuarial computation and reporting.

- Excel VBA + Finsoul Models: Customized for Bahrain’s compliance framework.

Our automation-driven approach ensures faster, more accurate, and regulator-ready valuation reports.

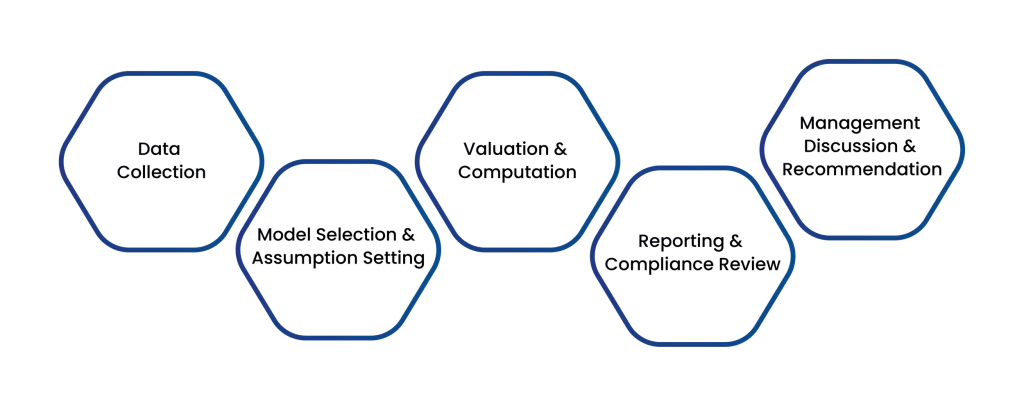

How our process of conducting works

Our step-by-step approach ensures accuracy, compliance, and seamless coordination:

- Data Collection: Gather employee data, benefits policies, and HR/payroll records.

- Model Selection & Assumption Setting: Define assumptions such as discount rates, inflation, and mortality tables.

- Valuation & Computation: Calculate present value using actuarial techniques and software.

- Reporting & Compliance Review: Prepare IAS 19-compliant valuation reports.

- Management Discussion & Recommendations: Explain findings and advise on financial strategy.

This structured process ensures every valuation is both accurate and regulator-ready.

Which documents are required for actuarial valuation

To initiate the valuation, you’ll need to provide the following:

- Employee master data (joining date, salary, DOB, service years).

- HR and payroll reports.

- Gratuity and benefit policies.

- Previous actuarial or financial audit reports.

- Financial statement extracts for reconciliation.

- Pension or insurance scheme documents.

Finsoul Bahrain assists in compiling and validating all documents before submission, ensuring a smooth and efficient process.

Eligibility Criteria

Actuarial valuation services apply to:

- Employers governed by Bahrain Labour Law.

- Companies preparing IFRS or IAS 19 statements.

- GCC-based corporations with Bahrain operations.

- Insurance, pension, and investment entities.

Whether you’re a startup or a listed firm, Finsoul Bahrain ensures you meet every compliance requirement seamlessly.

What Are the Typical Costs and Timeline?

Actuarial valuation costs and timeline in Bahrain depend on various factors, including:

| Service Stage | Scope of Work | Estimated Duration | Estimated Cost (BHD) |

|---|---|---|---|

| Data Collection | Gathering employee records, HR policies, payroll data | 3 – 5 Days | 400 – 800 |

| Model & Assumption Setting | Defining discount rates, inflation, mortality tables | 2 – 3 Days | 300 – 600 |

| Valuation & Computation | Applying actuarial techniques and software | 4 – 7 Days | 700 – 1,200 |

| Reporting & Compliance Review | Preparing IAS 19‑compliant valuation reports | 3 – 5 Days | 500 – 1,000 |

| Management Discussion & Advisory | Explaining findings and recommending financial strategy | 2 – 3 Days | 400 – 700 |

Disclaimer: Costs and timelines vary depending on workforce size, benefit complexity, and reporting standards.

Challenges Businesses Face Without Actuarial Valuation

Without actuarial valuation, companies often misstate employee liabilities in their financial statements, which can lead to non‑compliance with IFRS and CBB regulations. This not only weakens investor confidence but also exposes businesses to governance risks. During mergers or restructuring, inaccurate liability data can delay negotiations or result in unfair valuations. In addition, hidden risks such as pension shortfalls or medical liabilities may remain unnoticed, creating financial instability in the long run. Regular actuarial valuations prevent these issues by ensuring transparency, compliance, and reliable financial planning.

AI Integration in Actuarial Valuation

At Finsoul Bahrain, we use Artificial Intelligence (AI) to make actuarial valuations faster, more accurate, and insightful. AI tools help us process large employee datasets quickly, detect anomalies in benefit calculations, and validate assumptions such as discount rates or mortality tables. Machine learning models also forecast potential risks in pension or insurance schemes, giving management early warnings. By reducing human error and automating repetitive tasks, AI ensures valuation reports are reliable, regulator‑ready, and aligned with IFRS and IAS 19 standards.

Penalties for Non‑Compliance

Failure to conduct actuarial valuations or disclose employee liabilities accurately can lead to serious consequences in Bahrain. Companies may face fines from regulators, rejection of audit reports, and restrictions on participating in government tenders. Non‑compliance also increases scrutiny from the Central Bank of Bahrain (CBB) and the Ministry of Industry and Commerce (MOICT). Beyond regulatory action, businesses risk losing investor confidence, limiting access to financing, and exposing themselves to legal disputes. Regular actuarial valuations safeguard against these penalties by ensuring transparency, compliance, and financial stability.

Why Choose Finsoul Bahrain for Actuarial Valuation

- Certified Actuarial Expertise:

Experienced actuaries and financial analysts with GCC market knowledge. - Local Regulatory Knowledge:

In-depth understanding of Bahrain Labour Law, IFRS, and IAS standards. - Technology-Enabled Analysis:

Use of leading actuarial software and automated data models. - Transparent Pricing:

No hidden fees, just customized solutions that fit your business. - Trusted by Corporations:

Preferred partner for major Bahraini and regional firms. - End-to-End Support:

From data preparation to final report delivery and audit coordination.

Frequently Asked Questions

What is an actuarial valuation report?

An actuarial valuation report determines the present value of employee benefits and long-term liabilities based on actuarial models and financial assumptions. It ensures compliance with IAS 19 and helps organizations manage future obligations responsibly.

How often should a company conduct an actuarial valuation?

Most companies perform it annually, but businesses with high employee turnover or complex benefit plans may conduct it semi-annually for better accuracy and compliance.

What data is needed for actuarial valuation?

You’ll need employee demographics, salary history, service length, HR policies, and relevant financial records. Finsoul Bahrain helps you compile and verify all necessary information.

Why should I choose Finsoul Bahrain for actuarial valuation services?

Finsoul Bahrain partners with certified actuaries and ensures full compliance with IFRS and Bahrain Labour Law, delivering accurate, regulator-ready reports trusted by auditors and financial institutions.