Agreed Upon Procedure (AUP) Services – Finsoul Bahrain

Clarity, Construction strategy, Excel with AUP

Reliable and well-supported financial information is at the heart of every strong business decision. When stakeholders, lenders, and partners expect clarity, companies need a method that confirms the accuracy of specific financial or operational details without committing to a full audit. That’s exactly where Finsoul Bahrain steps in, offering a structured approach that boosts transparency and confidence through precise verification backed by solid evidence.

For startups, SMEs, and large organizations, agreed-upon procedures provide assurance that reported numbers are accurate and reliable. These targeted checks help businesses maintain credibility, meet expectations, and keep their operations running smoothly with information they can truly rely on.

Why Do Businesses Require Agreed Upon Procedures?

Many companies don’t need a full audit; they want certain financial or operational details checked. With an agreed upon procedures audit, management can verify specific items and meet regulatory or contractual requirements without incurring additional cost or complexity.

This approach builds trust with investors, reduces the risk of errors, and delivers results faster than a full audit. For businesses seeking reliable information and greater control, these focused checks provide exactly what they need.

What Are the Common Areas Covered in AUP Engagements?

AUP engagements can be designed to match a company’s specific needs. They are commonly used to check items such as cash balances, bank records, revenue recognition, contract compliance, inventory counts, and asset details.

These focused reviews help organizations get clear, dependable results on the areas that matter most. Many companies choose agreed upon procedures when they want precise findings without the time or cost of a full audit.

What Challenges Do Companies Face When Conducting AUP in Bahrain?

Companies may encounter issues such as unclear expectations for procedures among stakeholders, incomplete records, or limited internal expertise. Many also struggle to meet reporting deadlines or interpret findings correctly.

This is where the right professional guidance makes all the difference. With clearly defined, agreed-upon procedures, the entire process becomes smoother and more dependable.

What Documents Are Required for AUP?

To carry out an AUP engagement effectively, companies typically prepare:

- Financial statements and ledgers

- Bank statements with reconciliations

- Contractual agreements

- Inventory and fixed asset records

- Supporting documents for transactions under review

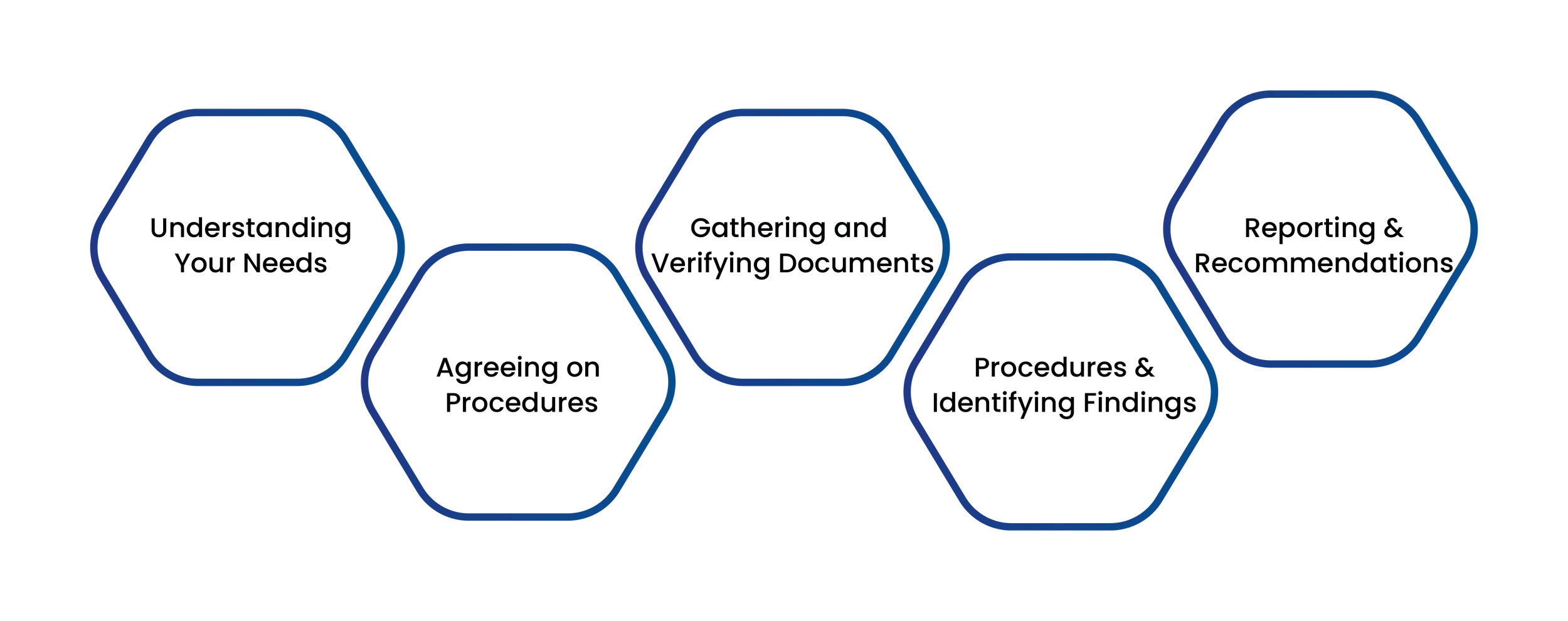

How Does Finsoul Bahrain Perform the AUP Process?

Our team follows a structured approach to deliver precise, agreed-upon procedures.

Step 1: Understanding Your Needs

We begin with a consultation to learn your business objectives and identify the specific areas that require verification. This ensures the process is focused and efficient.

Step 2: Agreeing on Procedures

You and your stakeholders confirm the exact checks to be performed. Clear agreement on scope and expectations helps avoid misunderstandings later.

Step 3: Gathering and Verifying Documents

Our team collects all necessary records, including financial statements, contracts, and asset lists, and verifies their completeness before proceeding.

Step 4: Performing Procedures and Identifying Findings

We carefully follow the agreed procedures, documenting results and objectively highlighting any discrepancies or unusual items.

Step 5: Reporting and Recommendations

A clear, professional report is delivered that summarizes procedures, findings, and actionable recommendations. We also provide guidance to help your business address any gaps or improve controls.

How Are Findings Reported in AUP Engagements?

AUP reports clearly outline the procedures performed and include all observations, confirmations, and any exceptions identified. These reports focus on facts and do not provide an audit opinion, making the findings straightforward to understand.

This structured approach helps stakeholders interpret results accurately while maintaining confidentiality and professional standards. Well-prepared reports turn agreed-upon procedures into a practical tool for informed decision-making and business confidence.

What Are Common Mistakes Businesses Make During AUP?

Many businesses make mistakes that can affect the outcome of their AUP engagements. Common issues include submitting incomplete documents, misunderstanding the scope, overlooking internal control weaknesses, delaying communication, and failing to meet regulatory requirements.

These missteps can lead to confusion, delays, or inaccurate results. Working with experienced professionals ensures your agreed upon procedures standard is maintained, providing clear findings and reliability from start to finish.

Recommended Best Practices for Effective AUP

To maximize benefits, businesses should agree on scope and objectives early, provide complete and accurate data, communicate clearly with stakeholders, and use standardized templates.

Engaging experienced professionals ensures procedures are performed correctly and efficiently. Following these best practices guarantees that Expert Agreed Upon Procedure Bahrain engagements deliver clear, reliable, and actionable results.

How Does AI Enhance Accuracy and Efficiency in AUP?

Modern AI tools make agreed-upon procedures faster and more accurate by automating data extraction, detecting anomalies, and monitoring high-risk areas in real time. This reduces the risk of human error and ensures that every detail is thoroughly checked.

Analytics dashboards simplify reporting and provide clear insights, making the results easy to understand. By combining AI with professional expertise, we deliver efficient, reliable, and user-friendly AUP services that help businesses make informed decisions.

Typical Costs & Timelines for AUP Engagements

The cost and timeline of an agreed-upon procedures engagement are flexible, designed to deliver efficient and reliable results.

| Engagement Size | Estimated Timeline | Estimated Cost |

|---|---|---|

| Small | 1–2 weeks | BHD 800 – BHD 1,500 |

| Medium | 2–4 weeks | BHD 1,500 – BHD 3,000 |

| Large or multi-location | 4–8 weeks | BHD 3,000 – BHD 6,000 |

Disclaimer: The above timelines and costs are estimates for guidance only. Final pricing and duration are determined after reviewing the scope and complexity of the engagement.

Technology & Tools We Use

Advanced technology ensures accurate, efficient results from agreed-upon procedures. The tools we use and their purposes include:

- Microsoft Excel / Google Sheets – For organizing, analyzing, and reconciling financial data quickly and accurately.

- QuickBooks / Tally / Xero – Accounting software used to access and verify financial transactions and ledgers.

- ACL Analytics / IDEA – Audit and data analysis tools that detect anomalies, trends, and inconsistencies in large datasets.

- DocuSign / SharePoint – Secure platforms for sharing and managing contracts, agreements, and sensitive documents.

- Power BI / Tableau – Analytics dashboards that provide visual insights, summaries, and trends to support informed decision-making.

Industries We Serve

We provide services for a variety of industries. This includes manufacturing and industrial companies, trading and distribution firms, healthcare and education institutions, financial services and insurance providers, and construction and infrastructure businesses.

We also assist government and public sector organizations. Across Bahrain, companies trust our services for accurate, timely, and reliable verification to make better decisions and stay compliant.

Why Choose Finsoul Bahrain

Clients choose our services for our deep experience, use of advanced tools, and commitment to clear, transparent reporting. We deliver cost-effective solutions tailored to the unique needs of every project, ensuring reliable, actionable results.

Our approach is fully aligned with local regulatory standards, and our team has the expertise to apply procedures efficiently across different industries. This ensures businesses can make informed decisions with confidence and maintain full compliance.

FAQ's

What is the difference between an AUP and a full audit?

AUP focuses on specific checks, while a full audit provides an opinion on the overall financial statements.

How long does a typical AUP engagement take?

Timelines range from 1 to 8 weeks, depending on the scope.

What is an agreed-upon procedure?

It is a targeted verification performed in accordance with the client’s and stakeholders’ requests.

Can AUP procedures be customized for specific needs?

Yes, every engagement can be structured to address the exact details you want examined.

What type of businesses benefit most from AUP?

Any organization that needs focused verification without undergoing a full audit.

Does Finsoul Bahrain provide ongoing support after a report is filed?

Yes, we assist clients in understanding findings and planning next steps.