Corporate Loan

Where dreams take root, and businesses bloom.

Reliable financing can change the future of any company. The right funding helps businesses expand operations and strengthen working capital. It also supports investment in long-term projects. Structured borrowing keeps cash flow steady and makes obligations easier to manage. This creates stability and gives firms the confidence to grow. Well-planned funding turns ambitious goals into real results and provides support during financial pressure.

Finsoul Bahrain helps companies at every stage of the financing journey. Our Corporate Loan Services offer complete support including lender coordination, financial modelling, and compliance review. Each step is managed with care to ensure a smooth and successful loan process. With our expertise, financing becomes simple and reliable.

Finsoul Bahrain: Leading Corporate Financing Facilitator

Recognized as one of the most reliable advisors, Finsoul Bahrain helps businesses secure funding in the GCC. Our team maintains strong relationships with local banks, Islamic institutions, and regional lenders.

- Deep knowledge of lending regulations and Central Bank of Bahrain (CBB) requirements

- Expertise in preparing robust financial projections

- Transparent processes and dedicated advisory support

Why Companies in Bahrain Seek Corporate Loans

Economic growth and new regulations along with expanded SME financing programs have created a higher demand for loans. Companies need accurate financial statements and strong repayment plans to secure funding.

Professional guidance helps businesses meet lender requirements, evaluate risks and manage interest rates effectively. A business loan in Bahrain can support companies to expand operations, upgrade equipment and pursue key projects while maintaining financial stability.

Efficient Access to Corporate Funding

Growing SMEs, startups and mid-sized companies often need support to access the capital they require. Our Corporate Loan Services provide working capital loans to manage operations term loans and machinery financing for asset purchases project financing for long-term expansion trade finance facilities for import and export operations and Islamic financing arrangements for Sharia-compliant solutions.

These funding options help businesses meet immediate financial needs and plan for sustainable growth with confidence. Companies can secure the resources they need to expand operations, strengthen cash flow and pursue strategic initiatives effectively.

Types of Corporate Loans Offered by Finsoul Bahrain

Corporate Loan Services are designed to assist businesses at every stage of development.

Working Capital and Cash Flow Support

Overdraft facilities revolving credit lines short-term financing invoice-backed loans

Long-Term Funding and Project Assistance

Term loans for business expansion or capital projects project financing for new developments asset and equipment financing for infrastructure

Trade and International Financing

Letters of Credit LC letters of Guarantee LG import and export financing supply chain financing Sharia-compliant trade finance products

Financial Restructuring and Refinancing

Debt consolidation refinancing of existing liabilities interest rate optimisation

Benefits of Professional Loan Advisory

Using expert loan advisory services provides companies with access to banking specialists and financial networks higher approval rates with professionally prepared submissions and streamlined compliance and documentation. Businesses also benefit from improved negotiation of loan terms rates and repayment plans.

Professional guidance offers clear support throughout the financing process. These advantages make Corporate Loan Services a practical choice for companies seeking reliable financial support and smoother access to funding.

Challenges Companies Face During Loan Applications

Companies looking for funding often face serious challenges. Many struggle with weak or disorganized financial statements. Others submit incomplete documents or find it difficult to meet debt requirements. Limited knowledge of bank rules can also create obstacles. Poor feasibility studies reduce confidence in the project. Delays caused by CBB non‑compliance make the approval process even harder.

A professional Finance company helps businesses solve these problems. We prepare accurate financial statements, organize documents, guide companies on lender requirements and ensure CBB compliance. This support makes loan approval easier and faster.

Documents Required for Corporate Loan Applications

To secure a corporate loan, companies must provide:

Trade license and commercial registration copy

1–3 years audited or management financial statements

Bank statements

Cash flow reports and aged receivables/payables

VAT filings

Project or expansion plan with budget

Ownership and corporate structure information

Schedule of existing loans and liabilities

Feasibility studies if applicable

Loan Process with Finsoul Bahrain

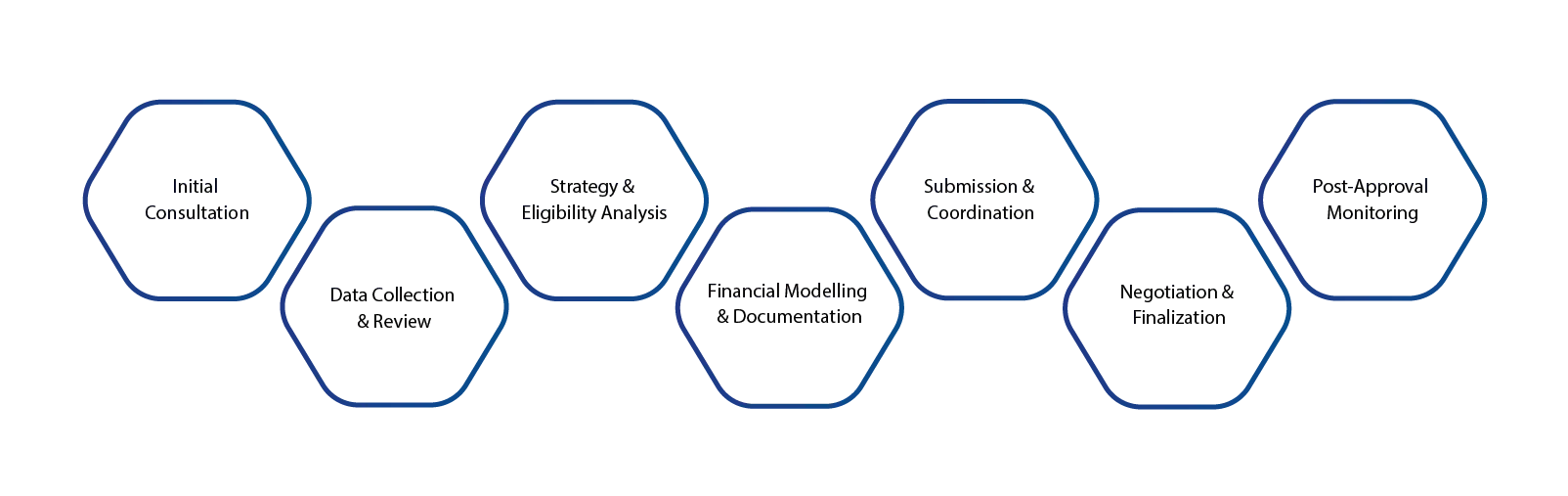

Corporate Loan Services require a structured approach. The process includes the following steps:

- Initial Consultation and Financial Assessment – Understand current financial position and funding needs

- Data Collection and Review – Gather financial statements, cash flow reports, and required documentation

- Strategy and Eligibility Analysis – Match loan types to business goals and eligibility criteria

- Financial Modelling and Documentation – Create accurate forecasts and bank-ready proposals

- Submission and Coordination – Submit applications and communicate with lenders

- Negotiation and Finalization – Secure the best terms, rates, and repayment schedules

- Post-Approval Monitoring – Provide ongoing support for compliance and performance

Project Costs & Timeline

| Phase | Typical Duration | Estimated Cost (BHD) |

|---|---|---|

| Eligibility review and initial assessment | 3–7 days | 500 – 1,000 |

| Documentation and financial modelling | 1–3 weeks | 1,000 – 2,500 |

| Bank review and approval | 2–8 weeks | 500 – 1,500 |

| Disbursement and post-compliance | As per bank process | 300 – 800 |

Timelines and costs may vary depending on company size, financial history, and loan type.

Technology and AI Integration

Corporate Loan Services use advanced technology to improve efficiency and accuracy. Financial modelling platforms provide precise forecasts. Document management and collaboration software streamline workflow. Loan tracking dashboards allow real-time progress monitoring. ERP and accounting system integrations ensure accurate data. Online lender portals make submissions smooth and reliable.

AI-driven tools add extra capabilities with credit scoring risk evaluation automated financial analysis predictive repayment forecasting and intelligent document review. These technologies help speed up loan approvals, deliver reliable results and support smarter financial decisions for businesses.

Industries Supported

Corporate Loan Services are available across multiple sectors including Trading and Manufacturing Construction and Real Estate Hospitality Technology and Startups Healthcare and Education Professional Services and Logistics and Contracting.

These services are designed to be flexible and adapt to the unique financing needs of each industry helping businesses secure funding for operations expansion and strategic projects.

Why Choose Finsoul Bahrain for Corporate Funding?

Finsoul Bahrain offers strong banking relationships that increase approval chances, transparent processes, a certified advisory team with GCC market expertise and robust financial modelling and feasibility assessment capabilities. Complete confidentiality and secure handling of documents ensure businesses can rely on trusted support.

The company provides recognised Financial Services and is considered among the Best corporate loan services. Our team helps businesses access loans efficiently with solutions that meet their unique financing needs.

FAQs

What documents are required for corporate loans?

Trade license, financial statements, bank statements, cash flow reports, VAT filings, ownership documents, existing loan schedule, and project plans.

How can SMEs improve their chances of securing funding?

Maintain organized books, prepare accurate financial statements, and provide realistic repayment plans.

Which banks provide financing for startups?

Finsoul Bahrain can connect startups to suitable local banks, Islamic lenders, and GCC institutions.

How long does the loan approval process take?

Approval timelines vary from a few weeks to several months depending on documentation, lender, and loan type.

How does Finsoul assist with lender negotiations?

We prepare detailed financial models, submit bank-ready documents, and negotiate terms, rates, and repayment schedules for the best outcome.