Financial Transformation Services in Bahrain

Financial Metamorphosis: Reshape, Reinvent, Rise

Business growth depends on efficient financial operations and clear decision-making. Financial Transformation Services help organizations modernize finance functions, improve efficiency, and gain better control through real-time data. By combining advanced technology with structured workflows, companies can strengthen reporting, streamline processes, and ensure finance supports long-term goals.

We deliver end-to-end Financial Digital Transformation for SMEs, startups, and large enterprises. These solutions comply fully with Bahrain’s regulatory requirements and are designed to be secure, reliable, and scalable. Through digital tools and intelligent workflows, organizations can reduce operational workload, improve financial performance, and achieve sustainable growth.

Why Do Businesses Require Financial Transformation?

Finance Transformation Consulting helps organizations manage financial operations efficiently while maintaining accuracy and compliance. These services enable businesses to:

- Improve efficiency across accounting, reporting, and transactional processes.

- Enhance the accuracy of financial statements and forecasts.

- Streamline budgeting, planning, and decision-making.

- Align financial strategy with overall business objectives.

- Adapt to digital transformation in financial services and evolving market demands.

By modernizing finance, companies not only optimize resources but also gain a strategic advantage in competitive markets.

Key Areas of Financial Transformation

Effective Financial Transformation Services focus on modernizing core financial functions to improve speed, accuracy, and control. This includes automating accounting and reporting processes, digitalizing workflows to reduce manual effort, and implementing ERP and cloud-based solutions for centralized financial management.

Process optimization helps control costs and improve operational efficiency, while AI-powered analytics support better decision-making through reliable data. Together, these improvements enable finance teams to work more efficiently and deliver greater value to the business.

Challenges Companies Face in Financial Transformation

Many businesses struggle with change when moving to new financial systems. Teams may resist new ways of working, while outdated processes slow progress and limit efficiency. A lack of experience with digital finance tools can also make implementation difficult. Managing large volumes of financial data and complying with regulations adds further pressure.

Financial Transformation Services help address these issues with a clear, structured approach. Expert support makes change easier for teams, replaces outdated systems with modern solutions, and ensures data is accurate and well integrated. Compliance is maintained throughout the process, allowing businesses to modernize smoothly and with confidence.

Documents Required for Financial Transformation

For a smooth transformation process, companies typically need to provide:

- Current financial statements and ledgers.

- Bank and transaction statements.

- Payroll and HR data.

- Existing budgeting and forecasting reports.

- Process documentation and internal controls.

How Finsoul Bahrain Implements Financial Transformation

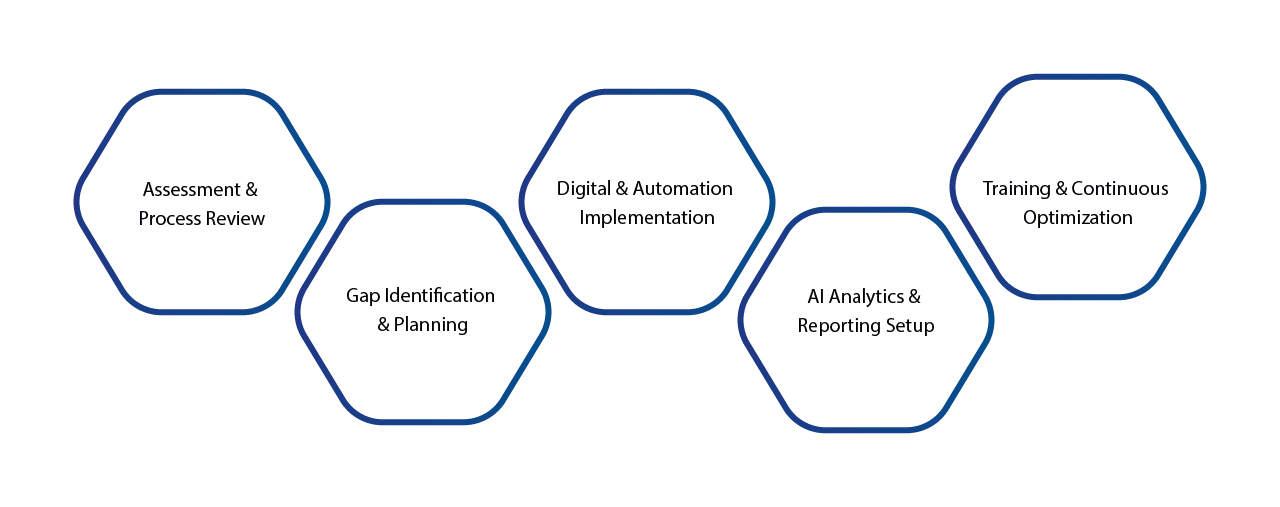

Financial Transformation Services are delivered through a structured and results-focused approach.

Step 1: Assessment and Process Review

We evaluate existing financial systems and workflows to understand challenges and business objectives.

Step 2: Gap Identification and Planning

Inefficiencies and areas for improvement are identified, and a clear transformation plan is created.

Step 3: Digital and Automation Implementation

Cloud-based systems and automated solutions are introduced to improve accuracy and efficiency.

Step 4: AI Analytics and Reporting Setup

AI-driven tools are implemented to support forecasting, performance tracking, and decision-making.

Step 5: Training and Continuous Optimization

Teams are trained on new workflows, while performance is monitored and optimized for long-term results.

How AI Accelerates Financial Transformation

AI technology is transforming Financial Transformation Services by automating repetitive accounting tasks, providing predictive analytics for budgeting and forecasting, and enabling real-time monitoring of financial performance. It also helps identify anomalies and potential risks quickly, keeping businesses in control of their finances.

Integrating AI into finance processes is a key part of Bahrain’s financial digitization. It improves reporting speed and accuracy, supports better decision-making, and enables organizations to focus on strategic growth rather than manual tasks.

Best Practices for Successful Financial Transformation

Successful transformation begins with setting clear goals and key performance indicators. Engaging stakeholders early and investing in staff training and change management ensures smooth adoption of new systems and processes.

Using scalable, flexible financial systems and regularly reviewing workflows enables continuous improvement. Following these best practices enhances the effectiveness of Financial Transformation consulting and drives better returns on investment.

Costs & Typical Timelines

Bahrain financial services projects often vary in scale, complexity, and timelines.

| Scale | Duration | Estimated Cost (BHD) |

|---|---|---|

| Small-scale | 2–4 weeks | BHD 1,130 – 2,640 |

| Medium-scale | 4–8 weeks | BHD 3,020 – 5,660 |

| Large-scale | 2–3 months | BHD 6,030 – 11,300 |

Disclaimer: Costs and timelines are approximate and may vary by project.

Technology & Tools We Use

Advanced tools are used for efficient Financial Transformation Services:

- Cloud Accounting Platforms (QuickBooks, Xero, Zoho Books): Real-time bookkeeping and secure access from anywhere.

- AI and Machine Learning Tools: Predictive analytics, anomaly detection, and smarter forecasting.

- ERP and Financial Management Software: Centralized operations and improved process efficiency.

- Data Visualization & Dashboards: Interactive charts for real-time monitoring and faster decisions.

- Automation Tools: Reduce manual effort and errors in reconciliations and reporting.

Industries We Serve

Our financial digital transformation services cater to a wide range of industries:

- Banking and financial services.

- Manufacturing and trading.

- Real estate and construction.

- Healthcare and education.

- Government and public sector.

- Startups and SMEs.

Why Choose Finsoul Bahrain

Finsoul Bahrain delivers expert Financial Transformation Services with a focus on results. Our experienced team combines financial modernization expertise with AI and automation to accelerate, optimize, and improve the accuracy of operations.

We offer solutions for both SMEs and large enterprises. With fully transparent processes, detailed reporting, and strict compliance with Bahrain and GCC financial regulations, every step of the transformation is secure, efficient, and designed to drive growth.

FAQ's

What is financial transformation, and why is it important?

Financial transformation modernizes processes, improves accuracy, and enables data-driven decision-making.

How financial digital transformation benefit businesses?

Small projects take 2–4 weeks, medium-scale projects take 4–8 weeks, and large-scale transformations take 2–3 months.

How does Finsoul ensure successful implementation?

Through structured assessments, AI integration, staff training, and continuous monitoring.

Can financial transformation be applied to SMEs?

Yes, SMEs can benefit greatly by streamlining operations and improving reporting accuracy.

How does AI support financial transformation?

AI automates repetitive tasks, predicts trends, identifies risks, and improves reporting accuracy.

What documents are required for a transformation project?

Current financial statements, bank statements, payroll data, budgeting reports, and internal process documentation.