Merger & Acquisition

Precision in Merger & Acquisition: Shaping Business Destiny

Merger & Acquisition services help businesses expand strategically, strengthen their market position, and create lasting value. The advisory process guides businesses, investors, and SMEs through each stage of an M&A transaction, making complex steps clear and manageable.

With expert mergers & acquisitions support, clients benefit from thorough due diligence, accurate valuations, smart deal structuring, and full regulatory compliance. From initial consultation to post-merger integration, Finsoul Bahrain provides complete end-to-end assistance to ensure a smooth, confident, and successful M&A journey.

FinSoul Bahrain: Your Trusted Partner in Mergers & Acquisitions

Businesses trust our merger and acquisition services because we simplify complex deals and ensure a smooth process from start to finish. Our certified team understands GCC business regulations, so each step is handled with accuracy and care. We also use advanced tools, including AI, to support due diligence and financial analysis. With clear pricing and a practical approach, clients can make confident decisions and complete their deals faster and with greater assurance.

Why Businesses Pursue Mergers & Acquisitions in Bahrain?

Companies use M&A to grow, expand, and strengthen their position in the market. It allows businesses to combine strengths, support long-term economic goals, and modernize operations through digital transformation

M&A also helps businesses reach new customers, enter new markets, and increase revenue. for business mergers and acquisitions, whether local or international.

Supporting SMEs & Growing Companies Through Every Transaction

We understand that small and medium enterprises have unique needs when it comes to merger and acquisition services. Our approach includes financial analysis and valuation to prepare for deals, identifying potential targets, and structuring partnerships for smooth investor negotiations.

We also make sure every transaction complies with commercial laws. This gives SMEs the confidence to move forward, backed by practical guidance for successful deals.

Core Transaction Support Services Offered by Finsoul Bahrain

Our transaction services provide the expertise needed at every stage.

Financial Due Diligence

Review financial statements and performance trends to identify risks and hidden issues. Assess earnings to support confident decision-making.

Valuation & Deal Pricing

Determine fair pricing using recognized valuation methods and industry benchmarks. Provide negotiation guidance for optimal outcomes.

Transaction Structuring

Design efficient structures such as asset or share sales and joint ventures. Evaluate tax and legal implications for smooth execution.

Post-Merger Integration

Align financial systems and processes. Support workforce planning, change management, and operational synergy monitoring.

Why Outsource M&A Advisory?

Engaging an expert merger and acquisition consultant ensures independent and unbiased advice throughout the transaction. Clients also gain access to specialized expertise and advanced analytical tools for informed decision-making.

This approach reduces the risk of overpaying and helps complete deals more efficiently, giving businesses confidence and peace of mind at every stage.

What Challenges Do Businesses Face During M&A Activities?

Mergers and acquisitions often bring challenges such as determining the true value of a company, conducting detailed due diligence, and uncovering hidden risks that may affect deal success. Companies also struggle with integration planning, regulatory requirements, and adapting to market conditions.

Our advisory services address these issues by providing accurate valuations, thorough due diligence, structured integration planning, legal and regulatory support, and market guidance. With this approach, mergers and acquisitions become easier, safer, and more successful.

What Information Is Required for Transaction Support?

To provide effective M&A advisory services in Bahrain, companies need to share key information about their business.

- Financial statements of the target company

- Business plans and forecasts

- Corporate documents and ownership structure

- Details of assets and liabilities

- Legal contracts and commercial agreements

- HR and payroll information

- Operational and performance metrics

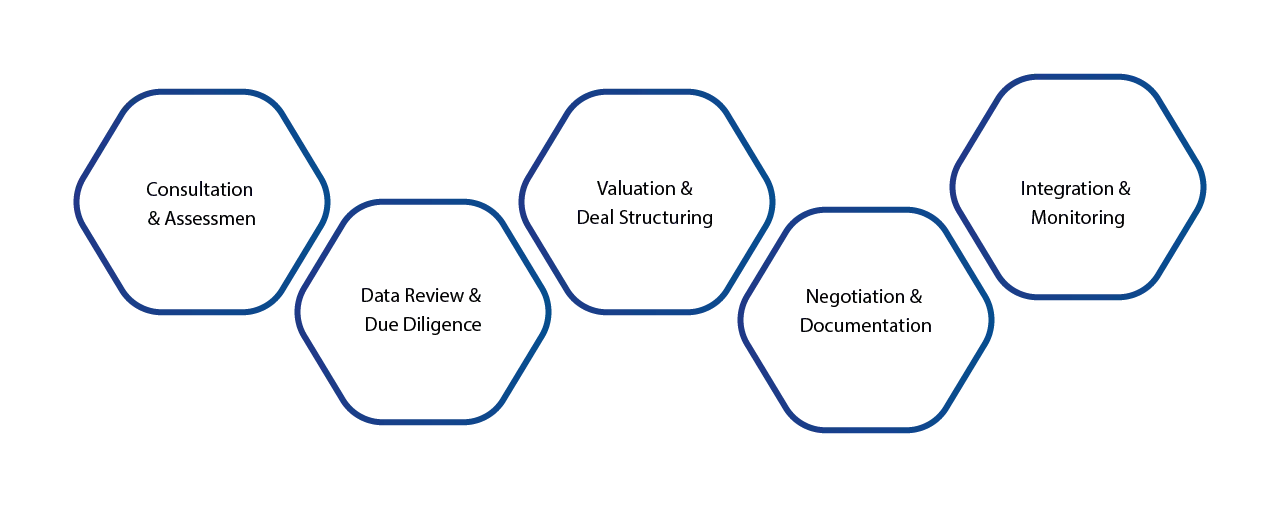

Our Step-by-Step M&A Process

Our team follows a structured approach to ensure every step is accurate, transparent, and aligned with your goals.

Consultation & Assessment – Understand your goals, evaluate opportunities, and plan the M&A process.

Data Review & Due Diligence – Collect and analyze financial, legal, and operational information to identify risks and opportunities.

Valuation & Deal Structuring – Determine a fair price and design the best transaction structure for your needs.

Negotiation & Documentation – Support deal negotiations and review all legal and financial documents for accuracy and compliance.

Post-Merger Integration & Monitoring – Align systems, processes, and teams, and track performance to ensure successful results.

Costs & Timelines for Transaction Support

The cost and timeline for merger and acquisition services are flexible to each deal, ensuring smooth and reliable results.

| Transaction Size | Estimated Duration | Estimated Cost (BHD) |

|---|---|---|

| Small Transactions | 2–4 weeks | 1,500 – 3,000 BHD |

| Medium-Sized Deals | 4–8 weeks | 3,000 – 7,000 BHD |

| Large / Multi-Entity Deals | 8–12+ weeks | 7,000 – 15,000+ BHD |

Note: Costs may vary depending on data availability, industry, and complexity.

AI Integration in M&A Support

Advanced AI technology enhances merger and acquisition services by identifying anomalies in financial statements, forecasting performance, and simulating valuations for more accurate decisions.

It also offers real-time dashboards for scenario analysis and streamlines the review of contracts and legal documents, making M&A transactions faster, more precise, and reliable.

Technology and Tools We Use

To deliver accurate and efficient merger and acquisition services, a range of advanced tools are used at every stage of the transaction.

- Cloud-Based Analytics Platforms – Analyze financial and operational data quickly.

- AI-Powered Due Diligence Tools – Detects risks and anomalies in financials and contracts.

- Financial Modeling Software – Build valuation models and forecast deal outcomes.

- Valuation Software & Industry Databases – Compare company value against market and industry benchmarks.

- Secure Data Rooms – Safely share sensitive documents with stakeholders during due diligence.

- Investor-Ready Reporting Dashboards – Provide clear visuals and reports for decision-making and presentations.

Industries We Serve

Our merger and acquisition services cater to a wide range of industries. We support businesses in Manufacturing & Trading, Financial Services, Real Estate & Construction, Technology & Startups, and Retail & E-commerce.

We also assist clients in Healthcare & Education, as well as Government & the Public Sector, providing solutions that meet the unique needs of each industry for smooth and successful transactions.

Why Choose FinSoul Bahrain for Transaction Advisory?

Finsoul Bahrain provides certified analysts with strong local and regional expertise. We use clear processes and accurate evaluations to handle every M&A transaction professionally and efficiently.

From planning to post-merger integration, full support is provided at every step. Clients benefit from smooth execution, strict confidentiality,ensuring successful and secure deals.

FAQ's

What are the stages involved in an M&A transaction?

The process includes deal assessment, due diligence, valuation, negotiation, structuring, documentation review, and post-merger integration.

How long does a typical deal take?

Small deals take 2–4 weeks, medium deals need 4–8 weeks, and large transactions may require 8–12 weeks or more.

What documents are required for Merger & Acquisition Services?

Financial statements, business plans, corporate records, contracts, HR data, asset details, and operational metrics are typically required.

How is the value of a company determined?

Valuation is based on financial performance, benchmarking, future cash flow expectations, and recognized valuation models.

Can FinSoul Bahrain assist with post-merger integration?

Yes. Support includes system alignment, process integration, workforce planning, and synergy monitoring.