Off-Shore Company Formation

Beyond Borders, Beyond Limits: Elevate Your Business with Offshore Excellence

Setting up an offshore company is an effective strategy for businesses seeking global expansion, tax efficiency, and international asset protection. An offshore structure enables companies to operate across borders seamlessly while enjoying privacy, simplified reporting, and flexible corporate governance.

Because offshore company formation involves navigating complex international regulations, professional guidance is essential to ensure compliance, reduce risk, and accelerate setup. Finsoul Bahrain provides expert advisory services for jurisdiction selection, documentation, corporate registration, banking, and ongoing compliance, ensuring smooth incorporation and operational readiness.

Leading Offshore Company Formation Consultant in Bahrain

Entrepreneurs and global businesses rely on professional advisors to simplify the off-shore company formation in Bahrain process. Choosing experienced consultants ensures faster approvals, accurate documentation, and long-term support.

Key Strengths:

- Expertise in multiple offshore jurisdictions

- Deep knowledge of international regulations and reporting frameworks

- Fast, transparent incorporation process

- Post-setup support, including compliance, banking, and renewal handling

Why Global Businesses Choose Offshore Company Setup

Offshore companies offer significant strategic advantages for businesses operating internationally. They enable reduced taxation and simplified reporting structures, helping companies manage finances efficiently while remaining compliant with global standards.

In addition, enhanced privacy, asset protection, and access to global banking services make offshore structures highly attractive for investors and entrepreneurs. These companies are particularly suitable for digital businesses, holding companies, and trading firms, providing flexibility in cross-border operations.

Compliance with international regulations, including FATF, ESR, AML, and KYC, ensures that the business operates transparently and avoids legal complications. These advantages make offshore company formation an ideal solution for businesses seeking international expansion and structured global operations.

Supporting Startups & SMEs in Offshore Company Formation

We support startups and SMEs in establishing effective offshore company formation structures by offering comprehensive guidance throughout the process. Our team helps founders select the ideal jurisdiction based on their business goals and operational needs, ensuring a strategic foundation for growth.

We provide thorough documentation support and compliance verification to meet international regulatory standards, reducing the risk of delays or legal complications. Additionally, we assist with offshore bank account opening to facilitate smooth financial operations and provide advisory services on tax planning and international structuring, helping businesses optimize their global expansion and future growth potential.

Core Services Offered

Jurisdiction Selection & Advisory

- Comparison of popular offshore regions

- Risk assessment and compliance evaluation

- Structuring recommendations for optimal efficiency

Company Registration & Documentation

- Preparation and filing of incorporation documents

- Beneficial owner registration and statutory filings

- Liaison with offshore authorities for smooth registration

Compliance & Regulatory Support

- AML/KYC documentation support

- Guidance on Economic Substance Regulations

- Ongoing compliance and annual filing maintenance

Banking & Post-Setup Services

- Assistance with offshore bank account opening

- Corporate governance support

- Renewal and annual maintenance handling

Why Companies Outsource Offshore Setup

Outsourcing ensures:

- Avoidance of delays caused by jurisdiction-specific requirements

- Accurate preparation of legal and corporate documentation

- Access to specialists familiar with global compliance standards

- Reduced risk of penalties due to incomplete filings

Professional guidance allows businesses to focus on growth while ensuring full compliance with international and local regulations.

Challenges Businesses Face During Offshore Incorporation

Businesses often face several challenges during offshore incorporation, including understanding the differences between jurisdictions, navigating strict KYC and AML requirements, and opening offshore bank accounts. Compliance obligations, such as ESR reporting, add another layer of complexity, while missing or incorrect documentation can cause further delays.

Structured professional support helps mitigate these challenges, ensuring accurate submissions, regulatory compliance, and a smooth offshore company registration process.

Documents Required for Offshore Setup

Accurate and complete documents are essential for smooth offshore company formation. These records ensure compliance with international regulations, facilitate bank account setup, and support timely registration.

Key Documents Needed:

- Passport Copies: For all shareholders and directors

- Proof of Address: Recent utility bills or official correspondence

- CV or Business Profile :Details of shareholders’ experience and background

- Business Plan / Activity Description :Outline of intended business operations

- Bank Reference Letters: As required by the jurisdiction or bank

- Source of Funds Declaration: Proof of capital origin for investment

- Corporate Documents: Required if a parent company or existing entity is involved

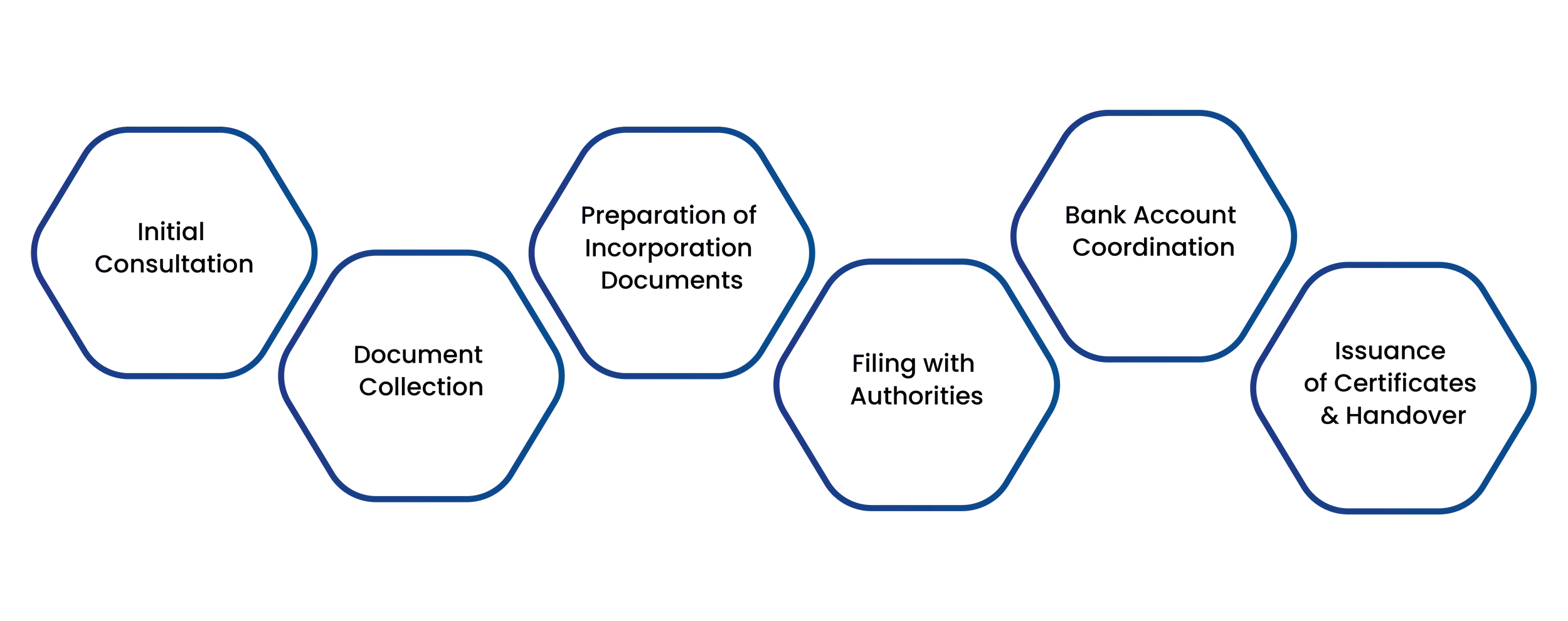

Step-by-Step Process for Offshore Establishment

- Initial Consultation & Jurisdiction Analysis :Evaluate business needs and select the best offshore location.

- Document Collection & Compliance Verification: Gather and verify all necessary documents.

- Preparation of Incorporation Documents :Draft MoA, CR forms, and beneficial ownership filings.

- Filing with Authorities & Company Registration :Submit to the relevant offshore authorities.

- Bank Account Coordination :Facilitate othe pening of offshore corporate accounts.

- Issuance of Certificates & Handover: Provide all official registration documents and compliance confirmations.

Project Timeline & Estimated Costs

| Service Type | Estimated Timeline | Estimated Cost (BHD) | Notes |

|---|---|---|---|

| Document Preparation | 2–5 days | 1,500 – 3,000 | Drafting and verification of incorporation documents |

| Authority Review & Approval | 1–3 weeks | 2,000 – 4,000 | Depending on jurisdiction and complexity |

| Bank Account Opening | 2–6 weeks | 1,500 – 3,500 | Coordinating with offshore banks |

| Post-Setup Compliance | Ongoing annually | Custom | Annual filings, renewals, and governance support |

Disclaimer: The estimated timelines and costs may vary depending on the chosen jurisdiction, corporate structure, and completeness of submitted documents. Contact us for professional guidance Customize to your business needs.

Technology & Tools We Use

We use advanced technology and tools to ensure a smooth and secure company setup process. Secure document management systems keep all sensitive data confidential, while digital compliance tools help maintain adherence to international regulations.

E-signature and e-filing platforms streamline submissions, and cross-border data management solutions enable efficient coordination across multiple jurisdictions, making the process faster and more reliable.

AI Integration in Offshore Company Formation

We us AI technology to enhance the efficiency and accuracy of the company formation process. AI-based jurisdiction comparison tools help identify the most suitable structure, while automated KYC and AML verification ensures full regulatory compliance.

Smart document extraction and compliance checks reduce manual errors, predictive alerts keep track of renewals and deadlines, and AI-assisted risk monitoring provides continuous oversight for international entities.

Industries We Serve

We provide offshore company formation services across various sectors:

- Trading & Import-Export :Streamlined compliance for international trade.

- E-commerce & Digital Services :Customize offshore structures for online businesses.

- Holding & Investment Firms: Efficient corporate setups for asset management.

- Logistics & Maritime: Support for cross-border operations and shipping.

- Technology Startups: Optimized structures for innovation-driven ventures.

- Consulting & IP-based Businesses: Assistance with intellectual property and service companies.

Why Choose Expert Support for Offshore Company Setup?

Professional guidance ensures faster and more accurate incorporation, minimizing errors and delays. Transparent support throughout the offshore company formation in Bahrain process provides clarity and compliance.

Finsoul Bahrain combines local knowledge with international jurisdiction expertise, offering Customize solutions for multi-jurisdiction structuring.

This approach ensures that offshore companies are compliant, strategically positioned, and ready for international operations.

FAQs

Which offshore jurisdictions are most suitable for new businesses?

Popular jurisdictions vary based on business activity, tax planning, and regulatory preferences. Guidance is provided to select the best option.

Can I open an offshore company without visiting the country?

Yes, remote incorporation is possible in many jurisdictions with proper documentation and compliance.

What is the difference between onshore and offshore entities?

Offshore entities are established in foreign jurisdictions for tax efficiency and international operations, while onshore entities operate under local laws.

Are offshore companies legal under international regulations?

Yes, offshore companies are fully legal when registered in compliant jurisdictions and adhere to AML, KYC, and tax reporting standards.

How long does it take to open an offshore bank account?

Typically 2–6 weeks, depending on jurisdiction, bank policies, and document readiness.