Tax Advisory Services

Managing taxes is important for every business. Professional tax advisory in Bahrain helps companies stay compliant, avoid mistakes, and plan more effectively. Clear guidance reduces extra costs, improves financial reporting, and builds trust with regulators.

Recognized for outstanding tax consultancy, the team features certified experts including CPAs, ACCAs, and CMAs. Their combination of advanced technical knowledge and extensive industry experience enables them to deliver accurate, dependable, and solutions across a wide range of business sectors.

Finsoul Bahrain: Leading Tax Consultant

Renowned for excellence in tax advisory services, the team consists of certified professionals such as CPAs, ACCAs, and CMAs. Their blend of technical expertise and hands-on industry experience ensures accurate, reliable, and solutions for diverse business needs.

We also offer tax consultancy services that give businesses a structured approach to compliance and planning. With technology‑enabled systems and workflows, our solutions ensure reliable and scalable tax advisory support for every organization.

Why Professional Tax Consultancy Matters in Bahrain?

Professional tax consultancy in Bahrain is essential to meet regulatory requirements and avoid costly penalties. Our services help companies optimize their tax planning & consulting, manage corporate filings, and maintain accurate records.

For businesses operating internationally, our corporate tax services prevent double taxation and align local reporting with global standards. Partnering with a skilled tax consultant ensures smooth navigation through complex tax landscapes.

Core Tax Services Offered by Finsoul Bahrain

Our corporate tax services help businesses streamline their financial management.

Corporate Tax Advisory

We provide corporate tax planning and structuring, ensure compliance with filings and documentation requirements, and offer guidance on cross-border transactions.

VAT & Indirect Tax Services

Our VAT and indirect tax services include VAT registration and return filing, reconciliation and correction support, and advice on exemptions or special schemes.

Personal & Executive Tax Planning

We assist with tax-efficient compensation and benefits, retirement and investment-related planning, and guidance for high-net-worth individuals.

AI & Technology Integration

Technology supports automated calculations and reporting, predictive analytics for future liabilities, and dashboards for monitoring deadlines.

Why Outsource Tax Advisory Services

Outsourcing provides access to skilled advisors without the need to hire full-time staff. Companies gain peace of mind, reduce the risk of mistakes, and save costs.

Using our expert tax consultancy services, businesses can focus on growth while we manage their compliance needs.

Common Challenges Businesses Face

Businesses today face frequent regulatory changes, complex cross-border tax rules, and limited internal expertise. Without proper support, these challenges can lead to mistakes, misreporting, and costly penalties.

Our tax consulting services provide the right solutions by combining certified expertise with advanced tools and integration of accounting data. We deliver accurate reporting and end‑to‑end support that help organizations remain compliant, improve financial efficiency, and achieve sustainable growth.

Documents Required for Tax Advisory

To provide effective guidance, we typically request:

- Past financial statements (1–3 years)

- VAT and tax filings

- Bank statements and transaction records

- Payroll and compensation data

- Contracts and agreements affecting taxes

- Budgets and forecasts

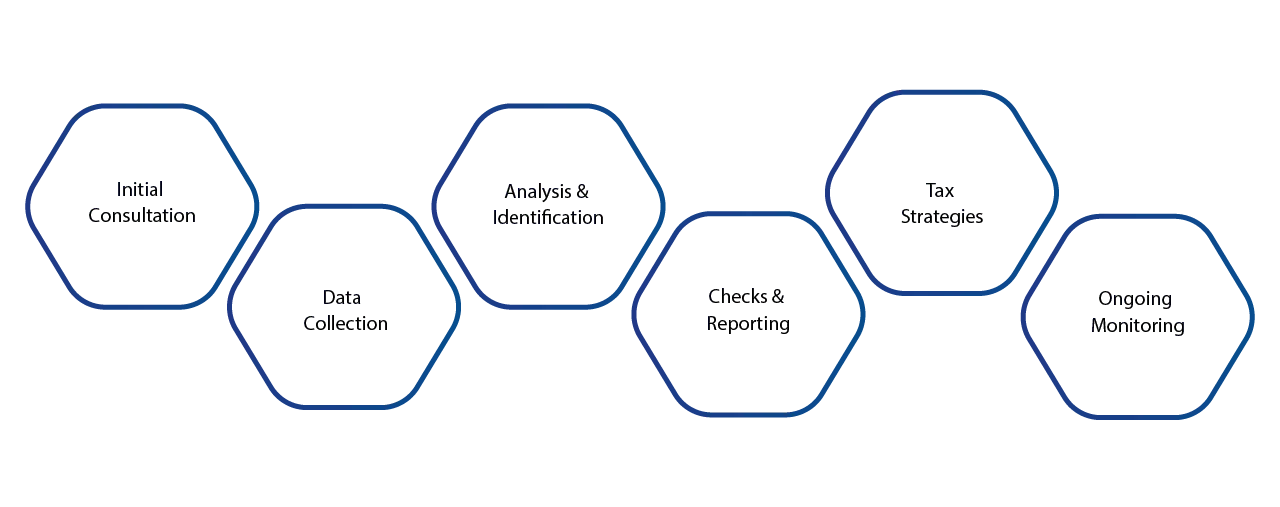

Process Followed by Finsoul Bahrain

We follow a structured, comprehensive process to ensure every client receives strategic tax advisory in Bahrain.

Step 1: Initial Consultation and Assessment

We begin by understanding your business, goals, and specific tax requirements.

Step 2: Data Collection and Verification

Our team gathers all relevant financial documents, past filings, bank statements, payroll records, and contracts.

Step 3: Analysis and Identification of Optimization Opportunities

We thoroughly review the collected information to identify potential tax-saving opportunities, compliance gaps, and areas for financial efficiency.

Step 4: Filing, Compliance Checks, and Reporting

We assist in preparing and submitting all required tax filings while ensuring full regulatory compliance.

Step 5: Recommendations for Future Tax Strategies

Based on our analysis, we provide actionable recommendations for long-term tax planning.

Step 6: Ongoing Monitoring and Advisory

We continuously monitor regulatory changes and your business’s tax position.

Project Costs & Timeline

The cost and duration of our services depend on the complexity of your business and the specific tax needs.

| Service Stage | Estimated Duration | Estimated Cost (BHD) |

|---|---|---|

| Initial Consultation | 3–5 days | 150 – 300 |

| Tax Planning & Advisory | 1–2 weeks | 500 – 1,200 |

| VAT Registration & Filings | Monthly / Quarterly | 100 – 400 per period |

| Corporate Tax Filing Support | Annually | 600 – 1,500 |

Disclaimer: Estimated costs and timelines are indicative and may vary depending on the specific requirements of the business.

Technology and Tools

We use advanced tools to enhance tax consultancy and improve accuracy.

- Tax compliance software – Ensures accurate filing and adherence to deadlines.

- Cloud accounting integrations – Streamlines financial data management across platforms.

- AI-assisted analytics – Identifies tax optimization opportunities and potential risks.

- Dashboard reporting tools – Provides real-time tracking of filings, payments, and deadlines.

AI Integration in Taxation

AI enhances tax consultancy services by enabling automated reconciliations, predictive analysis, and real‑time compliance monitoring. This technology delivers faster reporting and provides actionable insights that strengthen decision‑making and ensure accuracy.

With AI‑driven support, businesses gain efficiency, reliability, and a structured approach to compliance. The result is improved financial performance and greater confidence in meeting regulatory requirements.

Industries We Serve

Effective tax consultancy serves different industries, each with specialized compliance needs.

- Financial services

- Manufacturing & trading

- Technology startups

- Real estate & construction

- Healthcare & education

- Government and public sector

Why Choose Finsoul Bahrain

Choosing Finsoul Bahrain ensures you work with a dependable tax advisory firm committed to accuracy and sustainable growth. Our core strengths include:

- Certified experts with proven industry knowledge: Professionals who deliver accurate reporting and practical solutions.

- Technology‑enabled systems for efficiency and reliability: Advanced tools that streamline processes and reduce risks.

- Tax strategies aligned with business goals: Customized advisory designed to fit each organization’s needs.

- Comprehensive support from planning to compliance: Guidance that covers every stage of the tax cycle.

- Deep understanding of GCC regulations: Local expertise combined with a regional perspective for stronger results

FAQs

What does corporate advisory include?

Corporate tax planning, filings, cross-border support, and structured reporting.

How can SMEs optimize VAT compliance?

Through timely filings, reconciliations, and expert tax services.

Can Finsoul help with cross-border tax planning?

Yes, including guidance on international treaties and obligations.

How is AI used in tax advisory services?

AI automates calculations, reconciliations, and predictive reporting to improve efficiency.

What documents are needed to start tax advisory services?

Financial statements, bank records, VAT filings, payroll data, and contracts.